Ever notice how some trends just don’t seem to add up? Like, how can jewellery sales be down while everyone’s suddenly buying up gold ETFs? It’s a head-scratcher, right? You might think those two things go hand-in-hand, but the reality is a bit more nuanced. We’re going to dive into why these seemingly opposite trends are happening simultaneously and what it all means for the future of gold.

Declining Jewellery Demand: A Closer Look

Okay, so jewellery isn’t exactly flying off the shelves like it used to. But why? There’s actually a mix of factors at play, and they paint a pretty interesting picture of changing consumer habits and global economics.

Economic Slowdowns and Disposable Income

Let’s face it: when the economy’s a bit shaky, one of the first things people cut back on is discretionary spending. And jewellery, as beautiful as it is, definitely falls into that category for many. You know, that feeling when you have to choose between paying the bills and buying that sparkly new necklace? Yeah, not fun. So, economic uncertainty plays a big role in dampening jewellery demand, especially in regions heavily reliant on gold jewellery as a store of value.

Changing Consumer Preferences and Styles

Fashion is fickle, isn’t it? What’s hot today might be totally passé tomorrow. And guess what? That applies to jewellery, too. Younger generations, in particular, often prioritize experiences over possessions and are drawn to different styles. Maybe they’re more into minimalist designs, or perhaps they prefer sustainable and ethically sourced alternatives. Who knows? Trends change, and the jewellery market has to keep up – or risk getting left behind.

High Gold Prices Impacting Affordability

This one’s pretty straightforward. When gold prices soar, jewellery becomes more expensive. And when jewellery becomes more expensive, fewer people can afford it. Basic economics, right? It’s a bit like trying to buy a house when the market’s booming – suddenly, that dream home seems a lot further out of reach. You may consider looking into silver or other more affordable pieces instead, or simply put that purchase on hold until the prices drop.

The Rise of Gold ETF Investments

Alright, so jewellery is struggling, but gold ETFs are booming. What’s the deal with that? Well, it all boils down to how people perceive gold as an investment versus a consumer good.

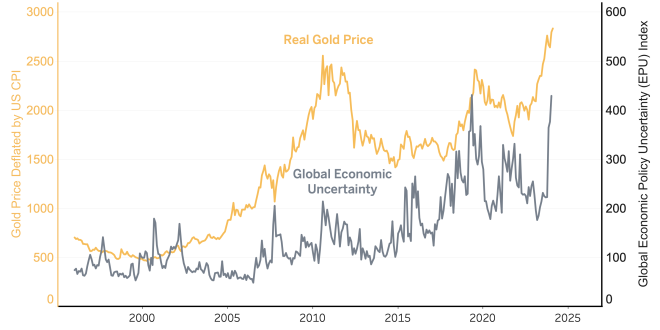

Safe Haven Asset in Times of Uncertainty

When the world feels like it’s on the verge of, well, something, investors tend to flock to safe-haven assets. And gold has always been a classic choice. It’s seen as a stable store of value that can weather economic storms. Think of it as a financial security blanket – it might not be the flashiest investment, but it offers a sense of calm during turbulent times. Especially when other investments seem risky, you see an increased demand for gold.

Liquidity and Accessibility Advantages

Here’s a thing: buying physical gold can be a hassle. You’ve got to worry about storage, insurance, and potential theft. Gold ETFs, on the other hand, offer a much more convenient way to invest. You can buy and sell them just like stocks, making them highly liquid and accessible to a wider range of investors. Much easier, isn’t it?

Transparency and Low Storage Costs

Another advantage of gold ETFs is their transparency. You know exactly what you’re buying – a share that represents a specific amount of gold. Plus, you don’t have to worry about those pesky storage costs associated with physical gold. It’s a pretty straightforward and cost-effective way to add gold to your investment portfolio. Many would even consider it a smarter approach.

The Divergence Explained: Key Factors

So, how do we make sense of these seemingly conflicting trends? It really comes down to understanding the different motivations behind buying jewellery versus investing in gold ETFs. And you also have to consider where in the world you are.

Investment vs. Consumption: Two Different Motives

This is the crux of the matter. People buy jewellery for a variety of reasons: to celebrate milestones, express their personal style, or simply because they like how it looks. It’s a consumption-driven purchase. Gold ETFs, on the other hand, are primarily an investment. People buy them to preserve capital, hedge against inflation, or diversify their portfolios. Different goals, different behaviors.

Regional Variations in Gold Demand

It’s also important to remember that gold demand varies significantly across different regions. In countries like India and China, jewellery has a deep cultural significance and is often seen as a status symbol and a form of savings. However, in other parts of the world, gold is primarily viewed as an investment asset. So, global trends can be misleading if you don’t account for these regional differences.

Impact of Technology and Alternative Investments

Don’t forget about the rise of cryptocurrencies and other alternative investments. These new options are competing for investors’ attention and capital. Some investors might see Bitcoin as a digital version of gold, while others might be drawn to the higher potential returns (and higher risks) of other alternative assets. The investment landscape is constantly evolving, and that’s impacting demand for all types of assets, including gold.

Future Outlook for Gold Demand

So, what does the future hold for gold? Will jewellery demand continue to decline? Will gold ETFs continue to soar? It’s tough to say for sure, but we can make some educated guesses based on current trends.

Projected Trends in Jewellery Consumption

Jewellery consumption is likely to remain somewhat subdued in the near term, especially if economic uncertainty persists. However, there’s still potential for growth in emerging markets and among younger consumers who are embracing new styles and brands. The jewellery industry needs to adapt to these changing preferences to stay relevant.

Growth Potential for Gold ETF Investments

Gold ETFs have a pretty bright future. As long as global economic and political uncertainties remain, investors will continue to seek safe-haven assets. Plus, the convenience and accessibility of ETFs make them an attractive option for both institutional and retail investors. I wouldn’t be surprised if they gained even more popularity.

The Role of Central Banks in the Gold Market

Don’t forget about central banks! They’re major players in the gold market, and their buying and selling activity can have a significant impact on prices. Some central banks hold gold as part of their reserves, and their decisions to increase or decrease those holdings can influence overall demand. It’s something to keep an eye on.

So, there you have it. The diverging trends of declining jewellery demand and increasing investment in gold ETFs are a complex issue with multiple contributing factors. It reflects shifting economic realities, changing consumer preferences, and the evolving nature of the investment landscape. Ultimately, understanding these trends can help you make more informed decisions about your own investments and purchases. Maybe it’s time to rethink your approach to gold – are you going to wear it, or invest in it? Or both?

seeme

seeme