You know, gold’s been having a moment. And by “moment,” I mean a pretty solid run that’s got Western investors all hot and bothered. We’re talking about levels of investment not seen in four years, folks! Why? Well, pull up a chair, and let’s dive into this shiny situation. The bull market continues, but is it sustainable? Should you jump on the bandwagon? These are the questions we’re pondering today.

Key Drivers Behind the Western Gold Rush

So, what’s fueling this renewed love affair with gold? It’s not just one thing; it’s a cocktail of concerns and opportunities. Let’s break it down, shall we?

Geopolitical Uncertainty and Safe Haven Demand

The world feels a bit like a rollercoaster these days, doesn’t it? Between international tensions and political shifts, it’s enough to make anyone a little anxious. And when people get anxious, they tend to flock to safe havens. Gold, being the OG safe haven, gets a lot of love. It’s like that comforting security blanket you had as a kid, only shinier and more valuable. I remember clinging to mine during scary movies. Ah, nostalgia!

Inflationary Pressures and Eroding Purchasing Power

Inflation, that sneaky thief, is still hanging around, eating away at your hard-earned cash. You go to the grocery store, and suddenly, your usual haul costs, like, twice as much! Gold, historically, has been seen as a hedge against inflation. The idea is that as the value of currency decreases, the price of gold tends to rise. So, some people see gold as a way to protect their purchasing power. Smart move, maybe? Or maybe it’s just wishful thinking…

Weakening Confidence in Traditional Financial Systems

Let’s be honest, recent events haven’t exactly inspired confidence in traditional banks and financial institutions. Remember that whole saga earlier this year? Shaky ground makes people nervous, and nervous people look for alternatives. Gold, with its tangible nature and history as a store of value, suddenly looks pretty appealing. It’s like switching from a rickety old bridge to a solid, golden path. Or something like that. I’m no poet.

Impact on Gold Prices and Market Dynamics

All this Western investment isn’t happening in a vacuum. It’s having a real impact on the price and the way gold trades.

Recent Price Surges and Technical Breakouts

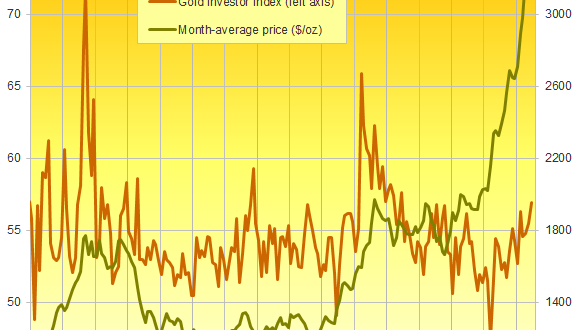

We’ve seen some pretty impressive price jumps recently, haven’t we? Gold has broken through resistance levels that analysts have been watching for ages. It’s like watching a racehorse finally surge ahead of the pack. The question is, can it maintain that lead? Or will it stumble?

Increased Trading Volume and Liquidity

With more investors jumping into the gold game, the trading volume has naturally increased. This means it’s easier to buy and sell gold without significantly affecting the price. More liquidity is generally a good thing, making the market more efficient. But, hey, increased volatility can come with the territory, so buckle up.

Changes in Investor Sentiment and Positioning

The mood around gold has definitely shifted. More and more investors are adopting a bullish outlook, meaning they expect the price to keep rising. This optimism is reflected in their investment strategies, with many increasing their holdings. But sentiment can be fickle, right? What happens when the mood changes?

Regional Variations in Western Gold Demand

It’s not a uniform wave of gold-buying across the West. Different regions have different preferences and approaches.

North American Interest: ETFs and Physical Bullion

In North America, you see a mix of interest in gold ETFs (Exchange Traded Funds) and physical gold bullion. ETFs are like a convenient way to invest in gold without actually holding the metal yourself. Physical bullion, on the other hand, is the real deal – bars and coins that you can stash away in a vault (or under your mattress, no judgment). I kinda like the idea of having a gold bar under my mattress…

European Uptick: Central Bank Reserves and Individual Investors

Europe is seeing an increase in gold demand from both central banks, who use it to diversify their reserves, and individual investors looking for safe havens. It’s a double whammy that’s contributing to the overall increase in Western demand. Are they onto something we should all be considering?

Australian Market: Mining Sector and Investment Options

Down under, Australia’s gold market is closely tied to its robust mining sector. As a major gold producer, Australia offers a variety of investment options related to gold mining companies. It’s a different angle on investing in gold, linking it to the production side of things.

Potential Risks and Challenges

Now, before you go emptying your bank account to buy gold, let’s talk about some potential risks. Because, you know, there’s always a catch.

Interest Rate Hikes and Opportunity Cost

Rising interest rates can make gold less attractive compared to other investments that offer a yield, like bonds. It’s that whole “opportunity cost” thing. Are you missing out on potential gains elsewhere by parking your money in gold? Something to think about.

US Dollar Strength and Currency Fluctuations

Gold is often priced in US dollars, so a stronger dollar can make gold more expensive for investors using other currencies. Currency fluctuations can add another layer of complexity and risk to gold investing. It’s a bit like trying to navigate a maze while blindfolded…fun, right?

Profit-Taking and Potential Market Correction

What goes up must eventually come down, right? After a sustained bull run, there’s always the risk of profit-taking, where investors sell their gold holdings to lock in gains. This can lead to a market correction and a drop in prices. Timing is everything, as they say.

Future Outlook and Investment Strategies

So, where do we go from here? What’s the long-term play with gold?

Analyst Forecasts for Gold’s Performance

Analysts are all over the place with their predictions. Some are super bullish, expecting gold to continue its upward trajectory. Others are more cautious, warning of potential pullbacks. The truth is, nobody really knows for sure. It’s all just educated guessing. Take everything with a grain of salt, okay?

Diversification Strategies for Portfolio Resilience

Most financial advisors will tell you that diversification is key. Don’t put all your eggs in one golden basket. Gold can be a valuable part of a diversified portfolio, but it shouldn’t be the only thing you own. Spread your investments around to reduce your overall risk. It’s like making sure you have multiple escape routes in case of a zombie apocalypse…always be prepared!

Long-Term Investment Perspective on Gold

Gold is often seen as a long-term investment, a store of value that can hold its own over time. If you’re thinking about investing in gold, it’s important to have a long-term perspective and not get caught up in short-term price fluctuations. Think of it as planting a tree – you’re not going to see results overnight, but over time, it can grow into something substantial.

Alright, so Western gold investing is definitely having a moment, driven by a mix of fear, uncertainty, and the search for value. But like any investment, it comes with risks and rewards. It’s up to you to weigh those factors and decide if gold fits into your overall financial strategy. Do your homework, talk to a financial advisor, and don’t let the gold rush fever cloud your judgment. Maybe it’s the right move for you, or maybe not. Either way, stay informed and stay savvy! And hey, if you do strike gold, remember who gave you the heads-up! Just kidding… mostly.

seeme

seeme