The cost of owning a home in the United States is steadily increasing, and a significant contributor to this rise is the escalating cost of home insurance. As premiums surge across the nation, affordability concerns are becoming more prevalent, leaving homeowners struggling to protect their most valuable asset. So, what’s causing this mess, and how can you possibly navigate it? Let’s dive in, shall we?

Factors Driving Up Home Insurance Costs

Alright, let’s get down to brass tacks. What’s making home insurance so darn expensive? It’s not just one thing, unfortunately. It’s more like a perfect storm of different issues all hitting at once.

Increased Frequency and Severity of Natural Disasters

Seems like every year we’re hearing about another major hurricane, wildfire, or some other crazy weather event. These disasters aren’t just scary; they’re incredibly costly. Insurance companies have to pay out a ton of claims, and guess who ultimately foots the bill? You do, through higher premiums. Makes you wonder if that weather app is worth checking or not, huh?

Rising Construction and Labor Costs

If something bad does happen to your home, the cost to rebuild or repair it has gone through the roof. Lumber prices, labor shortages…you name it. Everything is more expensive. This definitely bumps up the amount insurance companies have to shell out, and yup, that means higher premiums. Can’t catch a break, can we?

Litigation and Fraud

Sadly, not everyone plays fair. Some people try to game the system with fraudulent claims, and others are quick to sue. These legal battles and bogus claims cost insurance companies money, which, you guessed it, translates to higher premiums for everyone else. It’s a real drag when a few bad apples spoil the bunch, isn’t it?

Outdated Risk Models

Insurance companies rely on models to predict risk, but some of these models are, well, a bit behind the times. They might not fully account for the increasing effects of climate change or shifts in population density. If the models underestimate the risk, the insurance companies have to adjust, and those adjustments often mean higher costs for homeowners. Time to update those calculators, folks!

Regions Most Affected by Rising Premiums

Okay, so it’s bad everywhere, but some areas are getting hit harder than others. Let’s take a look at a few hotspots.

Florida: A Case Study in Insurance Crisis

Ah, Florida. Sunshine, beaches, and sky-high home insurance rates. Between hurricanes, flooding, and a complex legal environment, Florida’s insurance market is in rough shape. Some insurers are even pulling out of the state altogether. If you live there, you’re probably nodding your head right now, aren’t you?

California: Wildfire Risks and High Costs

California’s beautiful, but those wildfires are no joke. The risk of losing your home to a blaze is very real, and insurance companies are responding accordingly. Premiums in fire-prone areas have skyrocketed, making it tough for homeowners to get affordable coverage. Staying safe and insured? A tough balancing act.

Coastal Areas: Vulnerability to Hurricanes and Flooding

Living by the coast is dreamy, until a hurricane decides to pay a visit. Coastal areas are particularly vulnerable to severe weather, and the risk of flooding is always lurking. Home insurance rates in these regions reflect that risk, often costing homeowners a pretty penny. Guess you have to pay for that ocean view somehow, right?

Other States Experiencing Significant Increases

It’s not just Florida, California, and coastal areas. States across the country are seeing increases in home insurance premiums. From Texas to Oklahoma to even some of the more northern states, rising costs are becoming a widespread issue. So, chances are, wherever you are, you’re probably feeling the pinch.

Impact on Homeowners and the Housing Market

These rising insurance costs aren’t just a minor inconvenience; they’re having a real impact on homeowners and the housing market as a whole.

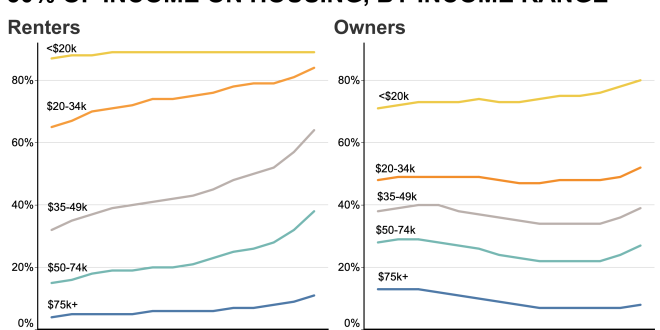

Affordability Challenges for Low- and Middle-Income Homeowners

For many families, especially those with tight budgets, these rising premiums can be a breaking point. It can mean choosing between protecting their home and paying for other essentials like food or healthcare. It’s a tough spot to be in, and nobody wants to see that.

Impact on Home Sales and Property Values

Think about it: if insurance costs are sky-high, fewer people can afford to buy a home. This can lead to a slowdown in home sales and potentially even a dip in property values. Makes you wonder if that dream home is really within reach, doesn’t it?

Increased Uninsured and Underinsured Properties

Some homeowners, faced with unaffordable premiums, might choose to go without insurance altogether, or opt for minimal coverage. This leaves them vulnerable to financial ruin if disaster strikes. It’s a risky gamble, but sometimes people feel like they don’t have a choice.

Potential for Government Intervention

If things get bad enough, you might see the government stepping in to try and stabilize the insurance market. This could involve creating state-backed insurance programs or implementing regulations to keep premiums in check. Whether that’s a good thing or not is a whole other can of worms, though.

Strategies for Mitigating Rising Insurance Costs

Okay, enough doom and gloom. What can you actually do about all this? Here are a few strategies to consider.

Shopping Around and Comparing Quotes

Don’t just stick with the first insurance company you find. Get quotes from multiple insurers and compare their rates and coverage options. You might be surprised at how much prices can vary. A little legwork can save you a lot of money. Time to put on your comparison-shopping hat!

Increasing Deductibles

A higher deductible means you’ll pay more out-of-pocket if you file a claim, but it can also lower your monthly premiums. Just make sure you can actually afford to pay that deductible if something happens. It’s a balancing act, for sure.

Improving Home Security and Mitigation Measures

Some insurance companies offer discounts if you take steps to protect your home, like installing security systems, reinforcing your roof, or clearing brush around your property. These measures can not only lower your premiums but also give you some peace of mind. Double win!

Exploring Government Assistance Programs

Depending on where you live, there might be government programs that can help you afford home insurance. These programs often target low-income homeowners or those in high-risk areas. It’s worth looking into to see if you qualify.

The Future of Home Insurance in the US

So, what does the future hold for home insurance? It’s tough to say for sure, but here are a few trends to keep an eye on.

Adapting to Climate Change and Evolving Risks

Insurance companies will need to get better at predicting and managing the risks associated with climate change. This could mean developing new risk models and offering incentives for homeowners to mitigate their risks. Adapt or get left behind, right?

Technological Innovations in Risk Assessment

Technology could play a big role in the future of insurance. Drones, satellite imagery, and advanced data analytics could help insurers assess risk more accurately and efficiently. This could lead to more personalized and fairer premiums. The future is now, or something like that.

The Role of Regulation and Industry Collaboration

Finding a balance between regulation and industry innovation will be key to ensuring a stable and affordable insurance market. Collaboration between government, insurers, and homeowners will be essential. Time to put our heads together, folks.

Ensuring Affordable and Accessible Coverage for All

Ultimately, the goal should be to make sure that everyone has access to affordable home insurance, regardless of their income or location. This will require creative solutions and a willingness to think outside the box. A roof over your head shouldn’t break the bank, right?

Navigating the rising costs of home insurance can feel like a daunting task, but it’s not impossible. By understanding the factors driving up premiums and exploring strategies for mitigation, you can take steps to protect your home and your wallet. It’s not a perfect system, and there’s still a lot of work to be done to ensure affordability and accessibility for all. But hey, maybe some of these ideas can point you in the right direction. And who knows, maybe sharing your own experiences can help someone else out there, too!

seeme

seeme