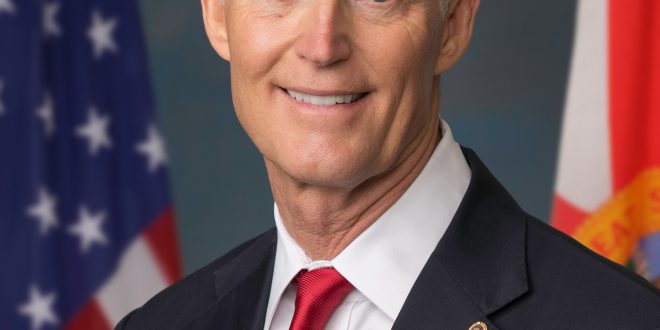

Rick Scott is back at it, trying to tackle the ever-present headache of homeowners’ insurance. He’s dusted off and reintroduced his tax relief proposal, aiming to throw a lifeline to Floridians (and others) grappling with those sky-high premiums. Honestly, with so many companies hiking rates or just straight-up leaving the state, it feels like something’s gotta give, right? This proposal’s supposed to offer some immediate help and maybe, just maybe, start to stabilize the market. Let’s dive into what it’s all about.

The Core of the Proposal: Federal Tax Credit

Details of the Tax Credit

So, what’s the nitty-gritty? Well, at the heart of this plan is a federal tax credit. Think of it as a discount on your taxes, specifically designed for homeowners who are getting hammered by insurance costs. It’d work by reducing your federal tax bill, which, let’s be honest, sounds pretty good right about now. Of course, the devil’s always in the details, isn’t it? The actual amount you could get and who qualifies are the big questions.

Targeting High-Risk Areas

Here’s the thing: not everyone’s in the same boat. The proposal wisely focuses on states that are constantly in the crosshairs of Mother Nature – places like Florida, Louisiana, and Texas. You know, the usual suspects when it comes to hurricanes and flooding. It’s almost like saying, “Hey, we know you guys are getting hit the hardest, so here’s a little something to help ease the pain.” Makes sense, doesn’t it? I mean, wouldn’t you agree that the tax credit should go where it’s needed most?

Arguments in Favor of the Proposal

Providing Immediate Relief

Proponents of this plan are shouting from the rooftops that it’s all about immediate relief. And you can see their point. When you’re staring down the barrel of unaffordable insurance, a little help can go a long way. It could be the difference between staying in your home and having to make some really tough choices. Nobody wants that, right?

Stabilizing the Insurance Market

Beyond just helping homeowners directly, the idea is that this proposal could inject some stability into the shaky insurance market. More money floating around might entice more insurers to come back or stick around, which means more competition. And what does more competition usually lead to? Lower prices! At least, that’s the hope. It’s like trying to jumpstart a car with a weak battery – a little jolt to get things going.

Potential Challenges and Criticisms

Cost to Taxpayers

Alright, let’s not get too carried away with the good news. There’s always a flip side, isn’t there? One of the biggest concerns is the cost. A federal tax credit sounds great, but who’s footing the bill? Yep, you guessed it – the taxpayers. Implementing this on a large scale could put a serious dent in the federal budget. Is it worth it? That’s the million-dollar question, isn’t it?

Effectiveness in the Long Term

And here’s another thing to chew on: is a tax credit really a long-term solution? Some folks argue that it’s just a band-aid on a much bigger wound. They say we need to be tackling the root causes of the problem, like those pesky building codes, investing in ways to protect our homes from damage, and making sure reinsurance is readily available. These are important to consider for a sustainable reform.

The Road Ahead: Prospects for Passage

Political Landscape

Okay, so what are the chances of this thing actually becoming law? Well, that’s where things get a little murky. It all depends on the political climate and whether Congress is willing to play ball. Bipartisan support is crucial. Without it, this proposal is likely dead in the water. Think of it like trying to bake a cake without all the ingredients – it just won’t rise properly.

Negotiations and Amendments

Even if it gets some traction, expect some serious haggling along the way. Proposals like this rarely make it through unscathed. There will likely be negotiations, compromises, and amendments galore. The final version could look quite different from what Rick Scott initially proposed. It’s a bit like that game of telephone we played as kids – the message always gets a little twisted along the way.

Rick Scott’s proposal is definitely a move to help out with those crazy homeowners’ insurance costs. Sure, it’s got its pros and cons, and the road ahead might be a bit bumpy, but it shows there’s at least some focus on tackling this big issue. What happens next is anyone’s guess, but it’s worth keeping an eye on to see if it might actually make a difference to your wallet. Maybe it’s something worth chatting about with your neighbors over the fence? Just a thought!

seeme

seeme