Property insurance non-renewal rates are climbing across the United States, but the surge is particularly pronounced in Florida, Louisiana, and Hawaii. A confluence of factors, including increasingly severe weather events, rising construction costs, and complex legal environments, are contributing to this trend, leaving homeowners facing higher premiums, limited coverage options, and, in some cases, the daunting prospect of finding insurance at all. This article delves into the specific reasons behind the escalating non-renewal rates in these states, explores the challenges faced by homeowners, and examines potential solutions to address the growing insurance crisis. If you’re a homeowner in these states, you might be feeling the pinch – or maybe you’re about to.

Florida’s Insurance Woes: A Perfect Storm

Florida, oh Florida. It’s not just sunshine and beaches, is it? The state’s insurance market is facing what you might call a perfect storm. You see those headlines about folks struggling to get their property insurance renewed? Yeah, that’s not just bad luck; it’s a systemic issue. What’s cooking this storm? A combo of tricky ingredients – and trust me, none of them taste good.

Hurricane Risk and Rising Reinsurance Costs

First up, hurricanes. Florida’s right in the path of some real whoppers, and insurers know it. Seems obvious, right? The more risk they take on, the more they have to pay to, well, insure themselves. That’s where reinsurance comes in. It’s basically insurance for insurance companies. When reinsurance costs go up, guess who ends up footing the bill? You, the homeowner. It’s a domino effect that’s hard to escape. Makes you wonder, doesn’t it, how many more storms we can actually afford?

Legislative Battles and Litigation

And then there’s the legal side. Florida’s been wrestling with a surge in insurance-related lawsuits, which, let’s be honest, nobody really wins except the lawyers. All this litigation adds up, driving up costs for insurers and contributing to those dreaded non-renewal notices. It’s a messy situation with no easy fixes, but one thing’s for sure: it’s making property insurance a real headache for everyone involved.

Impact on Homeowners and the Real Estate Market

So, what does all this mean for you, the homeowner? Higher premiums, for starters. And if you can even get insured, that is. Some folks are finding themselves dropped by their insurance company, scrambling to find coverage elsewhere. It’s impacting the real estate market too. Who wants to buy a house if they can’t insure it? It’s a big question mark hanging over Florida’s housing future, and frankly, it’s a bit scary.

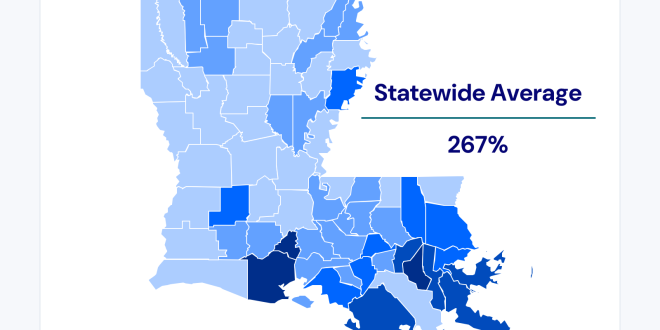

Louisiana: Coastal Vulnerability and Flood Insurance Challenges

If you think Florida’s got it rough, take a look at Louisiana. Talk about being between a rock and a hard place. This state’s got coastal vulnerability stamped all over it. Add to that some serious challenges with flood insurance, and you’ve got a recipe for an insurance crisis.

The Impact of Repeated Hurricanes

Hurricanes? Louisiana knows all about them. It feels like every other year, another one’s making landfall, tearing up homes and lives. These repeated hits have taken a massive toll on the insurance market. Companies are pulling back, and you can’t really blame them. It’s a high-risk game, and they’re trying to cut their losses. Still, it’s got to be tough if you live there, always wondering when the next one will hit.

The National Flood Insurance Program (NFIP) and Its Limitations

Then there’s the National Flood Insurance Program (NFIP). Sounds helpful, right? Well, it is, sort of. But it’s also got its limitations. It’s often not enough to cover the full cost of damages, and it’s becoming increasingly expensive. Plus, there’s the whole question of whether the NFIP itself is sustainable in the long run. It’s a critical program, but it needs some serious rethinking.

Finding Affordable Coverage in High-Risk Zones

Finding affordable coverage in high-risk zones? Good luck. It’s a real challenge. Homeowners are caught in a bind, needing insurance to protect their homes but struggling to afford the sky-high premiums. It’s a tough situation, and it’s forcing some hard choices. Do you stay and risk it? Or do you pack up and leave? Neither option is particularly appealing.

Hawaii: Volcanic Activity, Wildfires, and Unique Risks

Okay, let’s hop over to Hawaii. Paradise, right? Well, even paradise has its problems. It’s not just about idyllic beaches and Mai Tais. The Aloha State faces some unique risks that are driving up property insurance rates.

Volcanic Eruptions and Lava Flow Coverage

Volcanoes! Can you imagine worrying about lava flowing through your living room? It’s a real threat in some parts of Hawaii. Traditional insurance policies often don’t cover lava damage, or if they do, it comes at a steep price. So, you’re left wondering, how do you protect yourself from something so unpredictable?

Wildfire Threats and Prevention Efforts

And then there are wildfires. Seems crazy, right? Hawaii? But it’s true. Dry conditions and strong winds can turn a small spark into a raging inferno. Wildfires are becoming an increasing concern, and insurers are taking notice. They’re tightening their belts, and again, homeowners are feeling the squeeze.

The Cost of Paradise: Affordability and Availability

The cost of paradise? It’s getting higher and higher, especially when it comes to property insurance. Affordability and availability are major issues. You might find yourself priced out of the market, unable to afford the insurance you need to protect your home. It’s a harsh reality in a place that’s supposed to be a dream come true.

Underlying Factors Driving the National Trend

Okay, so Florida, Louisiana, and Hawaii are facing some specific challenges. But let’s not forget that there are some underlying factors driving up property insurance rates across the whole country.

Climate Change and Increased Natural Disasters

Climate change is real, folks. And it’s making natural disasters more frequent and more severe. We’re seeing more hurricanes, more wildfires, more floods. It’s all connected, and it’s all impacting the insurance market. Insurers are having to pay out more and more in claims, and they’re passing those costs on to you.

Inflation and Construction Costs

And then there’s inflation. Everything’s getting more expensive, including construction materials and labor. So, when a disaster strikes, it costs more to rebuild. Insurers have to factor that into their calculations, and again, it translates to higher premiums for you.

The Role of Insurance Regulations and Market Dynamics

Insurance regulations and market dynamics also play a big role. Some states have stricter regulations than others, which can impact how insurers operate. And the level of competition in the market can also affect rates. It’s a complex web of factors that all contribute to the overall cost of property insurance.

What Homeowners Can Do

Alright, so what can you actually DO about all of this? It’s easy to feel helpless, but there are some steps you can take to protect yourself.

Strengthening Homes Against Natural Disasters

First, think about strengthening your home against natural disasters. This could mean reinforcing your roof, installing hurricane shutters, or elevating your home if you’re in a flood zone. It’s an investment, sure, but it could save you a lot of money in the long run – and give you some peace of mind.

Shopping Around for the Best Rates and Coverage

Don’t just stick with the first insurance company you find. Shop around! Get quotes from multiple insurers and compare their rates and coverage. You might be surprised at how much prices can vary. It’s a bit of a hassle, I know, but it’s worth the effort.

Understanding Policy Details and Exclusions

Read your policy carefully! I know, it’s boring, but it’s important to understand what’s covered and what’s not. Pay attention to exclusions, which are things that your policy doesn’t cover. That way, you won’t be caught off guard if disaster strikes.

Potential Solutions and Future Outlook

So, what’s the long-term solution here? It’s a tough question, but there are some potential avenues to explore.

Government Intervention and Support Programs

Government intervention could play a role. This could mean providing subsidies to help homeowners afford insurance, or creating programs to help them strengthen their homes against natural disasters. It’s a controversial topic, but it might be necessary to ensure that everyone has access to affordable coverage.

Innovative Insurance Models and Technologies

We might also see some innovative insurance models and technologies emerge. Think about things like parametric insurance, which pays out based on specific events (like a hurricane’s wind speed) rather than actual damages. Or the use of drones and AI to assess damage more quickly and efficiently. The insurance industry needs to get creative to stay ahead of the curve.

The Importance of Mitigation and Resilience

Ultimately, the key is mitigation and resilience. We need to reduce our vulnerability to natural disasters by building stronger homes, protecting our coastlines, and addressing climate change. It’s a long-term effort, but it’s essential for creating a more sustainable future.

It’s a tough situation out there, especially if you’re living in Florida, Louisiana, or Hawaii. Non-renewal rates for property insurance are on the rise, and it’s putting a lot of pressure on homeowners. But don’t despair! By understanding the challenges, taking steps to protect yourself, and supporting efforts to create a more resilient future, you can navigate this insurance crisis and come out on top. Why not share your thoughts and experiences? I’d love to hear what you think.

seeme

seeme