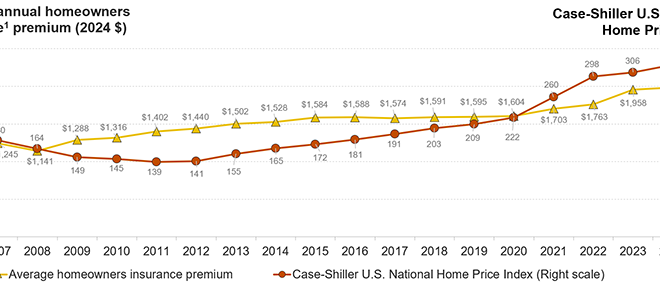

National home insurance costs are on the rise, and it’s not exactly cheerful news for homeowners. You’re probably noticing those premiums creeping up, putting an extra squeeze on your finances. But why is this happening? Well, there’s a mix of factors at play, from the increasing expense of construction to the ever-growing number and intensity of natural disasters. Getting a handle on these underlying causes is super important so you can navigate this tricky insurance world and make smart choices about protecting your place.

Understanding the Factors Driving Up Home Insurance Costs

Increased Frequency and Severity of Natural Disasters

Okay, let’s face it, Mother Nature’s been throwing some serious curveballs lately. Climate change is definitely a big player here, leading to more hurricanes, wildfires, and floods. You know, the kind that makes you wonder if you should build an ark instead of a new deck. These disasters cause a boatload of property damage, which means higher insurance payouts. And guess who ends up footing the bill? Yep, you do, through increased premiums. It’s a bit of a bummer, isn’t it?

Rising Construction Costs

Ever tried to renovate your bathroom lately? The cost of building materials and labor has gone through the roof. Seriously, it’s like every trip to the hardware store requires a second mortgage. When homes are damaged or destroyed, rebuilding them is way more expensive than it used to be. This jacks up insurance claims, which in turn, well, you know the drill – higher premiums for everyone. It’s a vicious cycle, really.

Inflation and Supply Chain Issues

Inflation. Sigh. It’s everywhere, isn’t it? And the insurance industry isn’t immune. Plus, those pesky supply chain disruptions? They’re not just about waiting longer for your online orders. They also mean longer repair times and higher costs when something goes wrong with your house. All of this contributes to those rising claim expenses that ultimately affect what you pay for your insurance. I mean, who knew getting a new window could be such a saga?

Regional Variations in Home Insurance Costs

Coastal Areas

If you live by the coast, you probably already know this: your insurance is likely higher. Homes in coastal regions are sitting ducks for hurricanes and flooding. My aunt had a place near the beach, and she was always fretting about the next big storm. All that potential damage leads to significantly higher premiums compared to those of us living inland. Lucky us, I guess?

Wildfire-Prone Areas

Out west, especially in places like California, wildfires are a serious concern. If your home’s in a wildfire-prone area, expect to pay more for insurance. It’s just a matter of risk assessment. Insurance companies aren’t exactly fond of the idea of your house turning into kindling. It’s a bit grim, but you’ve gotta admit, it makes sense.

Areas with Aging Infrastructure

Got an older home? Love the charm, hate the potential for problems. Old homes often need more TLC and are more likely to suffer from things like leaky pipes or dodgy wiring. This can lead to higher insurance premiums. It’s like your house is aging, and so is everything inside it! Sometimes, a little update can save you a bundle in the long run. Just something to think about.

Strategies for Mitigating Home Insurance Costs

Increasing Your Deductible

Okay, so one way to shave off some dollars each month is to increase your deductible. But, you know, make sure you can actually afford to pay that higher amount if you need to make a claim. It’s a bit like gambling. You save in the short term, but you’re taking a bigger risk. Just be smart about it.

Improving Home Security

Feeling like James Bond? Installing security systems, smoke detectors, and other safety gadgets can lower the risk of theft and fire. Plus, it might get you a discount on your policy. It’s a win-win. You protect your home, and you save money. Who doesn’t love that?

Bundling Insurance Policies

Bundling your home and auto insurance policies? Yeah, that’s a classic move. A lot of companies offer discounts if you do this. It’s like buying in bulk at Costco. You get a better deal, and you only have to deal with one company. Pretty neat, huh?

Shopping Around for the Best Rates

Don’t just stick with the first insurance quote you get. Shop around! Compare rates from different providers. It might take a little time, but it can save you a significant amount of money. And don’t be afraid to switch. Loyalty’s nice, but saving money’s nicer. I mean, isn’t that what we’re all after?

The Future of Home Insurance

Technological Innovations

Technology’s changing everything, right? In the future, things like smart home devices and drone inspections could help reduce risk and make the claims process smoother. Imagine a world where your fridge automatically orders a repairman when it detects a problem. Okay, maybe that’s a bit far-fetched, but you get the idea. The future’s coming, and it’s bringing gadgets with it.

Government Regulations and Support

Government initiatives and regulations could play a role in tackling the challenges of climate change and making insurance more affordable. It’s kind of reassuring to know there’s at least some oversight, isn’t it?

So, yeah, insurance costs are up, and it’s a bit of a headache. But, hopefully, now you’ve got a better understanding of why and what you can do about it. Shop around, stay safe, and maybe invest in a good weather app. And hey, if you’ve got any tips or stories of your own, feel free to share!

seeme

seeme