Hailstorms can wreak havoc on your home, leaving behind significant damage and potentially hefty repair bills. Navigating the insurance claim process after a hailstorm can be daunting, especially when you’re unsure of what your policy covers. This article will guide you through understanding your home insurance policy in relation to hail damage, ensuring you’re adequately protected and prepared to handle any potential repair costs.

Understanding Your Home Insurance Policy and Hail Damage

Okay, so you’ve just experienced a hailstorm. Not fun, right? One minute, everything’s sunny; the next, it feels like the sky is throwing ice cubes at your house. Now, the big question: Is your home insurance going to cover all this mess? It’s time to dive into the nitty-gritty of your policy. Honestly, who actually enjoys reading insurance policies? But trust me, understanding the basics can save you a ton of stress and money down the road. And hey, maybe you’ll find some unexpected coverage. Stranger things have happened!

What Types of Hail Damage Are Typically Covered?

Most standard home insurance policies cover hail damage, but what exactly does that mean? Well, it generally includes damage to your roof, siding, windows, and even your outdoor structures like sheds or garages. Think dents, cracks, and broken bits. But here’s a quirky thing I once heard: if your prized garden gnome collection gets pulverized, that might not be covered unless you have specific personal property coverage. See? It’s always something. Don’t assume anything; check the fine print, and maybe take a picture of your gnomes before the next storm. Just in case. You never know!

Key Policy Components Related to Hail Coverage

Alright, let’s talk about the key components. You’ve got your declarations page, which is basically the Cliff’s Notes version of your policy. Then there are the actual policy documents, which can be as thick as a Harry Potter book! Look for sections detailing covered perils (that’s insurance speak for risks), exclusions (what’s not covered), and of course, your coverage limits. Understanding these limits is crucial. Are you covered for the full replacement cost, or just the actual cash value, which factors in depreciation? Big difference! And make sure you know if there are any specific endorsements (add-ons) related to hail or wind damage. These little details can seriously impact your payout.

Deductibles and How They Impact Your Out-of-Pocket Costs

Ah, the deductible. That magical number you have to pay before your insurance kicks in. With hail damage, you might have a standard deductible or a separate, higher deductible specifically for wind and hail. For example, I remember my cousin having a $1,000 deductible for general claims, but a whopping $5,000 deductible for hail! Ouch! So, if the damage is less than your deductible, you’re paying out-of-pocket. If it’s way more, then your insurance covers the rest (up to your coverage limit, of course). Consider this when choosing your deductible; a lower deductible means higher premiums, but less out-of-pocket expense when disaster strikes. It’s a balancing act, really. What deductible works for you? Makes you think, right?

Documenting Hail Damage and Filing a Claim

Okay, the storm’s passed, and your house looks like it lost a fight with a giant ice machine. Time to spring into action! The next steps are all about documenting everything and getting that claim filed ASAP. Don’t delay; insurance companies usually have deadlines for reporting damage.

The Importance of Thorough Documentation

Picture this: you’re trying to explain to the insurance adjuster how the hail turned your siding into Swiss cheese. A picture is worth a thousand words, right? Take photos and videos of everything. Zoom in on the dents, cracks, and any other visible damage. Inside and out! Make a list of all damaged items, including their approximate value. If you have receipts or warranties, even better! The more evidence you have, the stronger your claim will be. Trust me, you don’t want it to turn into a “he said, she said” situation. Nobody wants that!

How to File a Hail Damage Claim with Your Insurance Company

Ready to file? Most insurance companies let you do it online, over the phone, or through their mobile app. Choose whichever method works best for you. Be prepared to provide detailed information about the damage, the date and time of the storm, and your policy number. Be honest and accurate in your descriptions. Don’t exaggerate, but don’t downplay the damage either. Keep a record of all communications with your insurance company, including dates, times, and the names of the people you spoke with. This will be helpful if any disputes arise later. Cover all your bases. That’s the name of the game!

What to Expect During the Claims Process

Once you file, the insurance company will assign an adjuster to your case. The adjuster will inspect the damage and assess the cost of repairs. They might ask you questions about the storm, your property, and the damage you’ve noticed. This is where all that documentation comes in handy! The adjuster will then prepare an estimate of the repair costs. Review this estimate carefully. If it seems too low or doesn’t include all the necessary repairs, don’t be afraid to question it. Get a second opinion from a contractor if needed. Remember, you have the right to negotiate a fair settlement.

Working with Insurance Adjusters and Contractors

Dealing with insurance adjusters and contractors can feel like navigating a minefield. But don’t worry, with the right approach, you can get through it unscathed. Here’s what you should know to ensure you get a fair settlement and quality repairs.

Understanding the Role of an Insurance Adjuster

The insurance adjuster is your point of contact with the insurance company. Their job is to assess the damage and determine how much the insurance company will pay for repairs. Keep in mind that they work for the insurance company, so they might not always have your best interests at heart. Be polite but firm in your interactions. Provide them with all the information they need, but don’t let them pressure you into accepting a low settlement. Do your homework, know your rights, and be prepared to advocate for yourself. You’re your best advocate, remember that!

Choosing a Reputable Contractor for Repairs

Finding a good contractor is crucial. Ask for recommendations from friends, family, or neighbors. Check online reviews and ratings. Get multiple quotes from different contractors. Make sure they are licensed, insured, and bonded. Don’t just go with the cheapest option. Consider their experience, reputation, and the quality of their work. A shady contractor can cause more problems than they solve, leaving you with shoddy repairs and a headache. Better to be safe than sorry, right?

Negotiating Repairs and Ensuring Fair Compensation

The adjuster’s estimate might not always cover the full cost of repairs. That’s where negotiation comes in. If you disagree with the estimate, get a written estimate from a reputable contractor. Present this to the adjuster and explain why you believe their estimate is too low. Be prepared to back up your claims with evidence, such as photos, videos, and expert opinions. If necessary, consider hiring a public adjuster to represent you. They can negotiate with the insurance company on your behalf and help you get a fair settlement. Don’t be afraid to fight for what you deserve.

Preventive Measures to Minimize Hail Damage

While you can’t control the weather, you can take steps to minimize the impact of hailstorms on your home. Think of it as prepping your house for battle. A little prevention can go a long way in reducing damage and saving you money.

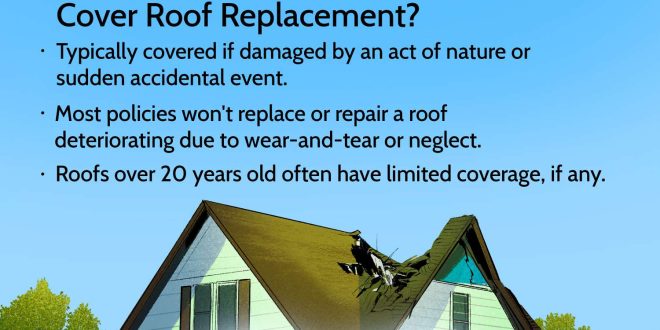

Protective Measures for Your Roof

Your roof is your home’s first line of defense against hail. Consider upgrading to hail-resistant roofing materials, such as impact-resistant shingles or metal roofing. These materials are designed to withstand the impact of hailstones and minimize damage. Regularly inspect your roof for any signs of wear and tear, such as loose or missing shingles. Address any issues promptly to prevent them from becoming bigger problems during a hailstorm. It’s like getting a flu shot for your house, in a way. Preventative care!

Protecting Siding and Windows from Hail

Hail can also damage your siding and windows. Consider installing hail-resistant siding, such as fiber cement or vinyl siding. These materials are more durable than traditional wood siding and can better withstand the impact of hailstones. Protect your windows with storm shutters or impact-resistant glass. You can also apply a protective film to your windows to help prevent shattering. It’s like giving your house a shield. Protect what you can!

Landscape Considerations for Hail-Prone Areas

Your landscaping can also play a role in protecting your home from hail damage. Plant trees and shrubs strategically to act as a barrier against hailstones. Choose hardy plants that can withstand hail damage. Avoid planting trees with weak branches that are likely to break during a storm. Mulch your garden beds to protect the soil and prevent erosion. And maybe, just maybe, move those gnomes inside when a storm’s brewing. I’m just sayin’!

When to Consider Appealing a Hail Damage Claim Denial

Sometimes, despite your best efforts, your insurance company might deny your hail damage claim. Don’t despair! You have the right to appeal their decision. Here’s what you need to know about the appeals process.

Reasons for a Claim Denial

There are several reasons why your claim might be denied. The insurance company might argue that the damage was pre-existing, that it wasn’t caused by hail, or that it’s excluded under your policy. They might also claim that you didn’t file the claim within the required timeframe. Review the denial letter carefully to understand the reason for the denial. This will help you prepare your appeal. Understanding why you were denied is key to knowing how to appeal. Knowledge is power!

Steps to Take When Appealing a Decision

Start by gathering any additional evidence that supports your claim. This might include photos, videos, contractor estimates, or expert opinions. Write a formal appeal letter to the insurance company, clearly stating why you believe their decision was wrong. Be specific and provide detailed explanations. Include all the supporting documentation you’ve gathered. Send the letter via certified mail with a return receipt requested, so you have proof that the insurance company received it. Keep copies of everything for your records. Be organized and persistent.

Seeking Legal Assistance if Necessary

If your appeal is denied, or if you’re struggling to negotiate with the insurance company, consider seeking legal assistance. An attorney specializing in insurance claims can review your policy, assess your case, and advise you on your legal options. They can also negotiate with the insurance company on your behalf and, if necessary, file a lawsuit to protect your rights. It might seem extreme, but sometimes, you gotta bring in the big guns to get what you deserve. If you’re feeling lost or overwhelmed, don’t hesitate to reach out for help.

Navigating home insurance and understanding hail damage coverage isn’t always a walk in the park, but hopefully, this guide has shed some light on the process. Remember, being informed and proactive is your best defense against unexpected repair costs. So, take a look at your policy, document everything, and don’t be afraid to ask questions. And hey, maybe invest in some gnome-sized helmets, just for kicks! Stay safe out there, and may your home be hail-proof!

seeme

seeme