Indiana homeowners are facing a growing financial burden as home insurance rates continue their upward trajectory. Factors ranging from increased severe weather events to rising construction costs are contributing to the pressure, leaving many residents scrambling to find affordable coverage and questioning the long-term sustainability of homeownership in the state. This article will delve into the reasons behind the rising costs, explore the impact on Indiana homeowners like yourself, and offer potential strategies for mitigating the financial strain. It’s a tough situation, and let’s be honest, nobody wants to pay more for anything, especially something as essential as home insurance.

Understanding the Factors Driving Up Home Insurance Rates

Increased Frequency and Severity of Weather Events

Home insurance costs are, unfortunately, directly related to the number and severity of claims filed. Indiana has seen an uptick in extreme weather events, including severe storms, flooding, and even those terrifying tornadoes, all of which can cause significant property damage. I remember one summer where it felt like we were constantly under a tornado watch! This heightened risk, naturally, translates to higher premiums for homeowners. It’s all about risk assessment, you know?

Rising Construction and Labor Costs

When a home is damaged and needs repair or, heaven forbid, complete replacement, the cost of materials and labor plays a massive role in the insurance payout. The construction industry has experienced some pretty significant inflation in recent years. I mean, have you tried to get a quote for any home improvement lately? It’s wild! This leads to higher claim costs for insurers and, you guessed it, higher premiums for homeowners. It’s a domino effect, really.

Supply Chain Disruptions

Closely related to those pesky construction costs, supply chain disruptions have made it difficult and seriously expensive to obtain necessary building materials. Remember when you couldn’t find toilet paper anywhere? Okay, it’s a bit different, but imagine that for plywood or roofing tiles. This scarcity further drives up the cost of repairs and replacements, which in turn impacts insurance rates. It’s frustrating, to say the least.

Increased Litigation and Fraudulent Claims

A rise in litigation related to insurance claims, and unfortunately, instances of fraudulent claims, can also contribute to increased costs. Insurers, sadly, must account for these factors when setting premiums, ultimately passing those costs on to policyholders. It kinda makes you wonder, doesn’t it? Are these increases really justifiable, or are we getting fleeced?

The Impact on Indiana Homeowners

Increased Financial Burden on Families

Higher insurance premiums place a significant financial strain on Indiana families, especially those on fixed incomes or with already tight budgets. It’s not just about home insurance; it impacts your ability to afford other essential expenses like groceries, healthcare, and maybe even a little fun now and then. Vacations? Forget about it! (Okay, maybe that’s a bit dramatic.)

Challenges to Homeownership

The rising cost of home insurance can make homeownership less accessible, particularly for first-time buyers and those with lower incomes. Think about it: saving for a down payment is hard enough! It can also lead to existing homeowners struggling to maintain their properties, deferring necessary repairs just to make ends meet. It’s a tough spot to be in, no doubt.

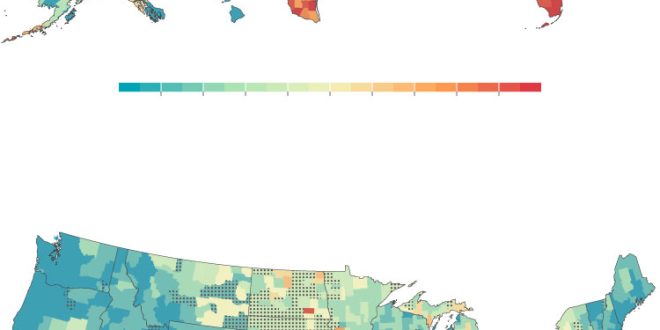

Regional Disparities in Rates

It’s important to note that the increase in home insurance costs may not be uniform across the entire state. Certain regions more prone to specific types of natural disasters, like those in flood plains or tornado alleys, may experience even higher rates. Location, location, location, right? Sometimes it feels like we’re paying extra just for the view…if you happen to have one!

Strategies for Mitigating the Financial Strain

Shopping Around and Comparing Quotes

You really should shop around and compare quotes from multiple insurance companies regularly to ensure you’re getting the best possible rate. Don’t be afraid to explore different coverage options and deductibles. It’s like finding the best deal on a car; you wouldn’t just go with the first one you see, would you?

Increasing Deductibles

Increasing the deductible on your home insurance policy can significantly lower your annual premium. However – and this is a big however – it’s crucial to ensure that you have sufficient savings to cover that deductible in the event of a claim. Otherwise, what’s the point? It’s a bit of a gamble, but sometimes it pays off. Just make sure you can actually afford it if something goes wrong, you know?

Home Improvements to Reduce Risk

Investing in home improvements that mitigate risks, such as installing storm shutters, reinforcing roofs (definitely something to consider), or improving drainage, can potentially lead to lower insurance premiums. Plus, you’ll sleep better at night knowing you’ve done something to protect your home. It’s a win-win, if you can swing it financially.

Bundling Insurance Policies

Bundling your home and auto insurance policies with the same company often results in significant discounts. It’s like a buy-one-get-one-free deal, but for insurance. Always worth checking out!

Seeking Assistance Programs

Explore available state and federal assistance programs that may provide financial aid to homeowners struggling to afford home insurance. You never know what’s out there unless you look. It’s like finding hidden money in your old winter coat – a pleasant surprise!

The Future of Home Insurance in Indiana

Potential for Further Rate Increases

Given the ongoing challenges related to climate change, construction costs, and other factors, it is, unfortunately, likely that home insurance rates in Indiana will continue to rise in the coming years. Buckle up, folks. It’s gonna be a bumpy ride. Maybe we should all invest in some weather-resistant bunkers…kidding! (Mostly.)

Importance of Proactive Risk Management

Homeowners and policymakers must proactively address the underlying risks that are driving up insurance costs. This includes investing in infrastructure improvements, promoting responsible land use planning, and educating residents about disaster preparedness. It’s a collective effort, and we all have a role to play.

Role of Government Regulation

Government regulation can play a role in ensuring that insurance companies operate fairly and that homeowners have access to affordable coverage options. Whether or not that actually happens is another story, isn’t it? But hey, we can always hope, right?

So, what can you do? You might feel like you’re just weathering the storm (pun intended!) when it comes to rising home insurance costs in Indiana. But arming yourself with information and taking proactive steps can make a difference. Compare those quotes, explore those discounts, and maybe start that home improvement project you’ve been putting off. It won’t solve everything overnight, but every little bit helps. And who knows, maybe by working together, we can make a difference in the long run. What are your thoughts on all of this?

seeme

seeme