Hurricane season is rapidly approaching, and experts are predicting an active year. Now is the time to ensure your home is protected not only from physical damage but also financially. Before the first storm hits, taking proactive steps to review your home insurance policy can save you considerable stress and money in the long run. It’s kind of like flossing – you know you should do it, but it’s easy to put off. But trust me, you don’t want to skip this! This article outlines three essential home insurance checks you should make to prepare for hurricane season.

Understanding Your Policy Coverage

Okay, let’s dive into the nitty-gritty of your home insurance. Do you even know what your policy covers? Many people just shove it in a drawer and forget about it. Don’t be one of those people! Understanding what’s included is the first step in protecting yourself from financial disaster. It’s kind of like knowing the rules of a game before you play – makes a big difference, right?

Dwelling Coverage: Enough to Rebuild?

Dwelling coverage is what helps you rebuild your home if, heaven forbid, it’s seriously damaged or even totally destroyed. It’s probably the most important part of your policy. Think about it: could you afford to rebuild your entire house out of pocket? Probably not. So, you need to make sure your dwelling coverage is actually enough to cover the cost of rebuilding in today’s market. Building costs have gone through the roof, haven’t they? Check if your policy covers “replacement cost” – which means you’ll get the actual cost to rebuild without depreciation – rather than “actual cash value,” which factors in depreciation. Big difference!

Personal Property Coverage: Protecting Your Belongings

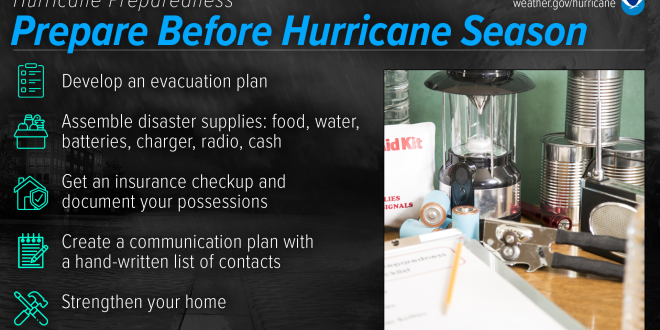

Don’t forget about all the stuff inside your home! Your furniture, clothes, electronics, that quirky collection of vintage teacups… it all adds up. Personal property coverage helps you replace these items if they’re damaged or destroyed. Creating an inventory of your belongings – photos, videos, receipts – can be a lifesaver when you file a claim. Trust me on this one; trying to remember everything you own after a disaster is a nightmare. Make sure you understand your coverage limits, especially for valuable items like jewelry or art. You might need extra coverage for those.

Liability Coverage: Protecting Yourself from Lawsuits

Here’s something you might not have thought about: what if someone gets injured on your property during or after a hurricane? Say a tree falls and injures a neighbor, or someone trips over debris while helping you clean up. Liability coverage protects you from potential lawsuits. It covers medical expenses and legal fees if you’re found liable. Now, how much is enough? Well, it depends on your situation, but err on the side of caution. A million dollars in coverage might sound like a lot, but lawsuits can be expensive. It’s better to be over-prepared than under-protected, wouldn’t you agree?

Reviewing Your Deductibles

Alright, let’s talk about deductibles. It’s one of those things that can really sting if you’re not prepared. A deductible is the amount you have to pay out of pocket before your insurance kicks in. Make sure you know what your deductibles are – especially your hurricane deductible.

Hurricane Deductibles: A Separate Threshold

Here’s the kicker: hurricane deductibles are often separate and higher than your standard deductible. Yep, that’s right. They’re designed to cover the specific costs associated with hurricane damage. So, if your standard deductible is $1,000, your hurricane deductible could be $5,000 or even higher. Understanding how this works is crucial because it directly impacts how much you’ll pay out of pocket after a storm. It’s a bit like a surprise tax, but hey, at least you can prepare for it, right?

Paying Attention to Percentage Deductibles

Some policies have percentage-based hurricane deductibles, which are calculated as a percentage of your dwelling coverage. For example, a 5% deductible on a $300,000 home would be $15,000! That’s a lot of money. These percentage deductibles can significantly increase your financial responsibility in a major storm. So, take a close look at your policy and understand whether you have a fixed-amount deductible or a percentage-based one. It makes a big difference when you’re budgeting for potential hurricane expenses.

Strategies for Managing Deductibles

So, what can you do about these hefty deductibles? Well, one strategy is to start saving specifically for potential deductible expenses. Think of it as your “hurricane fund.” Another option is to explore deductible buy-down programs offered by some insurance companies. These programs allow you to pay a higher premium in exchange for a lower deductible. It might be worth considering if you’re in a high-risk area or if you just want peace of mind. After all, nobody likes surprises when it comes to money, especially after a hurricane!

Checking for Exclusions and Limitations

Now, let’s talk about the fine print – the exclusions and limitations that can trip you up if you’re not careful. It’s like reading the terms and conditions; nobody wants to do it, but it could save you a headache later on.

Flood Damage: Not Always Covered

Here’s a big one: standard home insurance policies typically do not cover flood damage. Shocking, right? Especially when hurricanes often bring flooding. If you live in a flood-prone area, you absolutely need separate flood insurance. The National Flood Insurance Program (NFIP) is a good place to start. Don’t assume you’re covered for flooding just because you have home insurance. It’s a separate policy, and it’s essential for protecting your home from water damage caused by rising waters. You wouldn’t try to drive a car without insurance, so why risk your home?

Wind Damage Limitations: Understanding Specifics

Even if your policy covers wind damage, there might be limitations. Some policies exclude damage caused by pre-existing conditions, like a leaky roof or rotten siding. Others might have specific exclusions for certain types of wind-related losses, like damage to fences or detached structures. Read your policy carefully to understand what’s covered and what’s not. Addressing any pre-existing issues before hurricane season can save you a lot of trouble down the road.

Mold and Water Damage: Coverage Caveats

Mold and water damage resulting from a hurricane can be tricky to deal with. Some policies have coverage limitations for mold, while others might require you to take specific steps to prevent mold growth after a storm in order to be covered. For instance, you might need to dry out your home within a certain timeframe. Understand your policy’s provisions for mold and water damage, and take proactive steps to prevent mold growth after a storm. Quick action can prevent a small problem from turning into a major (and expensive) one.

Taking the time to review your home insurance policy before hurricane season is a smart move. Understanding your coverage, reviewing your deductibles, and checking for exclusions and limitations can give you peace of mind knowing you’re financially protected. It’s like having an emergency kit ready to go – you hope you never need it, but you’re sure glad you have it if you do. So, grab your policy, pour yourself a cup of coffee, and get to work. Your future self will thank you! Why not share your insights and experiences in the comments below?

seeme

seeme