Homeowners in North Carolina, get ready. Your insurance premiums are about to take a hike, and it’s happening soon – starting June 1st. The North Carolina Department of Insurance gave the nod, and honestly, it’s not exactly the best news. This increase is because of a mix of problems, like more severe weather, pricier construction, and even the rising costs for insurance companies to get their own insurance (reinsurance, they call it). So, how’s this going to hit your wallet? Well, it kinda depends on where you live, what kind of coverage you’ve got, and who your insurance company is.

Why Are Homeowners Insurance Rates Increasing?

Okay, so why is this happening? Let’s break it down, shall we?

Increased Frequency and Severity of Weather Events

North Carolina, bless its heart, is right on the coast. That means hurricanes, tropical storms, and all sorts of nasty weather love to visit. And these visits aren’t cheap. All that damage leads to a whole lot of insurance claims. So, to prepare for the next big storm – and let’s face it, there will be a next one – insurance companies have to, you guessed it, raise rates. Makes sense, right? I mean, someone’s gotta pay for all those repairs.

Rising Construction Costs

Ever tried to build something lately? Lumber prices alone could make your eyes water! The cost of everything from nails to hiring someone to swing a hammer has skyrocketed. This means that when a house gets clobbered by a tree (thanks, Mother Nature!), fixing it costs a whole lot more. Insurers have to shell out more, and that ultimately trickles down to you. It’s a bummer, I know.

Reinsurance Costs

Think of reinsurance as insurance for insurance companies. When things get really bad – like, “entire town underwater” bad – reinsurance kicks in to help the insurance companies stay afloat. But guess what? Reinsurance is getting more expensive, too! And guess who ends up footing that bill? Yep, you do, in the form of higher premiums. It’s like a never-ending cycle of cost increases.

How Will the Rate Hike Affect Homeowners?

Alright, enough doom and gloom. How’s this actually going to play out for you, the average North Carolina homeowner?

Varying Impact Based on Location

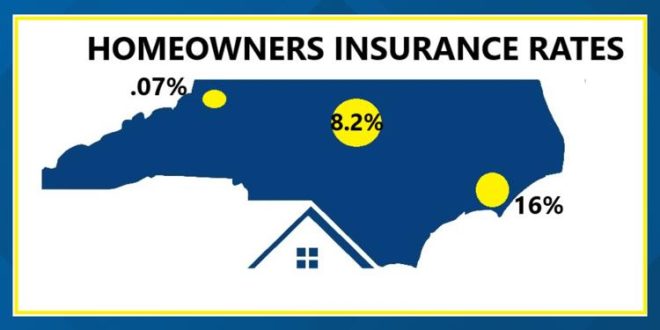

If you live right on the coast, batten down the hatches – figuratively and maybe literally. Coastal areas and places that tend to flood or get hammered by wind are probably going to see the biggest jump in rates. If you’re further inland, you might catch a bit of a break, but honestly, everyone’s probably going to see some kind of increase.

Impact on Different Coverage Levels

Got the Cadillac of insurance policies? You might be looking at a bigger price jump than someone with a more basic plan. It all depends on the fine print of your policy. Time to dust it off and give it a read, maybe?

Influence of Individual Insurance Providers

Here’s where things get a little tricky. Not all insurance companies are created equal, and they might not all implement these changes in the exact same way. So, the golden rule? Shop around! Don’t just stick with the first quote you get. Comparing rates could save you a pretty penny.

What Can Homeowners Do to Mitigate the Impact?

Okay, so you’re probably thinking, “Great, what can I actually do about this?” Good question!

Review Your Policy

Seriously, when was the last time you actually read your entire policy? Knowing what you’re covered for – and what you’re not – is super important. Make sure you’ve got enough coverage to protect your home, but don’t pay for bells and whistles you don’t need.

Shop Around for Insurance

I know, I already said it, but it’s worth repeating. Get quotes from multiple companies. You might be surprised at the difference in rates. And don’t be afraid to switch! Loyalty doesn’t always pay off in the insurance world.

Increase Your Deductible

This is a bit of a gamble, but hear me out. If you raise your deductible – the amount you pay out of pocket before your insurance kicks in – you can often lower your premium. Just make sure you can actually afford that higher deductible if disaster strikes.

Home Improvement and Mitigation Measures

Think about ways to make your home more resilient to the elements. Reinforce your roof, install storm shutters, improve drainage. Some insurance companies even offer discounts for these kinds of upgrades. It’s like killing two birds with one stone: protecting your home and saving money on insurance.

Where to Find More Information

Feeling a bit overwhelmed? Don’t worry, there are resources out there!

North Carolina Department of Insurance

Their website is a treasure trove of information about insurance regulations and consumer rights. Definitely worth a look.

Insurance Provider Websites

Your insurance company’s website should have specific details about the upcoming rate changes and your policy options.

Consumer Advocacy Groups

These groups can offer guidance and support as you navigate the often-confusing world of insurance.

So, yeah, homeowners insurance in North Carolina is going up. It’s not ideal, but hopefully, this gives you a better understanding of why, and what you can do about it. Don’t just sit there and take it; shop around, review your policy, and see what you can do to minimize the impact. It might take a little effort, but saving some hard-earned cash is usually worth it, right? And hey, maybe all this will encourage us to finally fix that leaky roof!

seeme

seeme