Buckle up, homeowners! It looks like home insurance premiums across the United States are heading for a potential doubling in the near future. Yeah, you read that right. This isn’t some far-off prediction; it’s a very real possibility that could leave you shelling out significantly more to protect your property. What’s driving this? A perfect storm of climate change, rising construction costs, and, believe it or not, an increasingly litigious environment. So, what can you do about it? Let’s dive into what’s happening and, more importantly, how you can protect your wallet and your home. It’s like preparing for a rainy day, except the rain is made of dollar signs!

Understanding the Rising Tide of Home Insurance Rates

So, why the heck are premiums threatening to skyrocket? It’s not just one thing; it’s a bunch of factors all ganging up at once. Think of it as a poorly-made cake, where every ingredient is a little off, leading to a pretty bad result. And trust me, nobody wants a bad insurance cake.

The Impact of Climate Change on Insurance Costs

Okay, let’s talk climate change. You knew this was coming, right? It’s not just about polar bears anymore; it’s hitting your pocketbook directly. Extreme weather events – hurricanes, wildfires, floods – are becoming more frequent and more intense. This means more claims, bigger payouts, and, you guessed it, higher premiums. I mean, who wants to insure a house that’s practically a guaranteed future claim? No insurance company in their right mind, that’s who!

Increased Construction and Labor Costs

Ever tried to renovate your bathroom lately? If so, you already know what I’m talking about. Construction materials are getting pricier, and finding a good contractor who isn’t booked out six months in advance feels like winning the lottery. So, when disaster strikes, rebuilding becomes a much more expensive endeavor. Insurance companies have to factor this in, naturally, and they do so by raising premiums. It’s simple math, really, but it’s math that stings.

The Role of Litigation and Fraud

Now for the slightly less obvious culprit: lawsuits. An increasingly litigious society, coupled with instances of insurance fraud, adds to the overall cost of doing business for insurance companies. These costs are then passed on to you, the homeowner, in the form of higher premiums. It’s almost like we’re all paying for the sins of a few bad apples. Sigh. It’s not really fair but that’s how the world works, isn’t it?

Geographic Hotspots: Where Rates are Climbing Fastest

Not all areas are created equal when it comes to insurance hikes. Some regions are getting hit harder than others. It’s kind of like how some people get mosquito bites more than others – totally unfair, but definitely a thing.

States at High Risk of Natural Disasters

If you live in Florida, Louisiana, California, or any other state prone to hurricanes, wildfires, or earthquakes, you might want to sit down for this. These states are seeing the most dramatic increases in home insurance rates. It’s just the reality of living in a high-risk zone. Insurance companies are basically saying, “We’re happy to insure you, but it’s gonna cost ya!” And who can blame them, really?

Urban Areas and Infrastructure Challenges

It’s not just coastal states. Urban areas, with their aging infrastructure and higher population density, also face unique challenges. Things like burst pipes, power outages, and even just plain old theft contribute to higher claim rates, which in turn drive up premiums. So, even if you’re not worried about hurricanes, your city dwelling might still be costing you more than you think.

Protecting Yourself: Strategies to Minimize the Impact

Okay, enough doom and gloom. What can you actually do to fight back against these rising rates? Turns out, quite a bit! It’s all about being proactive and thinking strategically. Like, if you know it’s going to rain, you bring an umbrella, right? Same idea here.

Reviewing and Optimizing Your Coverage

First things first: take a hard look at your current policy. Are you over-insured? Under-insured? Do you really need all those bells and whistles? It’s time to have a serious conversation with your insurance agent and make sure you’re getting the best coverage for your needs, without paying for stuff you don’t need. Don’t be afraid to ask questions, even if they seem dumb. It’s your money, after all!

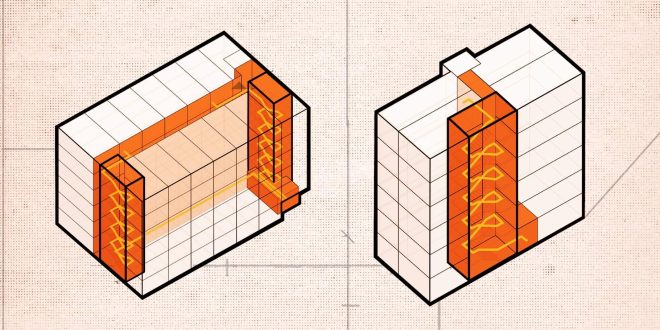

Home Hardening and Mitigation Measures

Want to lower your risk profile? Invest in home improvements that make your property more resilient to disasters. Think reinforced roofs, storm shutters, and flood-proofing measures. Not only will this protect your home, but it could also qualify you for insurance discounts. It’s a win-win! Plus, you’ll sleep better at night knowing your home is a little safer.

Shopping Around and Comparing Quotes

This is a no-brainer, but it’s worth repeating: always, always, always shop around for the best rates. Don’t just stick with the first insurance company you find. Get quotes from multiple providers and compare them carefully. You might be surprised at how much you can save just by doing a little research. It may be boring but it is totally worth it.

Exploring Alternative Insurance Options

If traditional insurance is becoming too expensive, don’t despair. There are alternative options out there worth considering. It’s like finding a secret menu item at your favorite restaurant – you just have to know where to look!

Surplus Lines Insurance

Surplus lines insurance is a type of coverage that’s offered by companies that aren’t licensed in your state. It’s typically used for high-risk properties that traditional insurers won’t cover. It might be a bit more expensive, but it could be your only option if you’re struggling to find coverage elsewhere. It’s the insurance of last resort, but sometimes last resorts are your best bet.

Government-Sponsored Programs

Depending on where you live, there might be government-sponsored insurance programs available to help you afford coverage. These programs are often designed to assist homeowners in high-risk areas who can’t afford traditional insurance. Do some research and see if there are any programs in your state or county that you might be eligible for. You never know what kind of help is out there until you look!

The Future of Home Insurance in America

So, what does the future hold for home insurance in America? It’s hard to say for sure, but one thing is clear: the industry is changing rapidly. It’s like trying to predict the weather next year! Good luck with that.

Potential Policy Reforms and Innovations

There’s a growing push for policy reforms that would make insurance more affordable and accessible, particularly for low-income homeowners. We might also see innovations like parametric insurance, which pays out based on specific triggers (like a hurricane reaching a certain wind speed) rather than on actual damages. This could make the claims process faster and more efficient. Fingers crossed!

Adapting to a Changing Risk Landscape

Ultimately, the key to navigating this changing landscape is to be informed, proactive, and adaptable. Understand the risks you face, take steps to mitigate those risks, and be prepared to adjust your coverage as needed. It’s not going to be easy, but with a little effort, you can protect your home and your financial future.

Well, that’s the gist of it. Home insurance premiums on the rise is a serious issue. It’s definitely worth understanding and taking action to protect yourself. Don’t just sit back and watch your rates double! Take control, explore your options, and maybe even share your own experiences and tips with others. After all, we’re all in this together, right? Now, if you’ll excuse me, I’m off to reinforce my roof! Just kidding… maybe.

seeme

seeme