Homeowners across the nation are facing a concerning trend: rising home insurance costs. It’s enough to make you wonder if owning a home is becoming a luxury, isn’t it? This surge in premiums can be attributed to a complex interplay of factors, primarily the increasing frequency and severity of natural disasters coupled with the impact of tariffs on building materials. These forces are pushing insurance companies to reassess risk and adjust their pricing models accordingly, leaving homeowners with potentially significant financial burdens.

The Growing Threat of Natural Disasters

Increased Frequency and Intensity

Climate change is widely recognized as a major driver of more frequent and intense weather events. Hurricanes seem to be angrier, wildfires are more widespread, floods are more devastating… you get the picture. It’s like Mother Nature is sending us a not-so-subtle message.

Impact on Insurance Claims

The higher the frequency and intensity of natural disasters, the more insurance claims are filed. It’s a no-brainer, really. And all those claims? Well, they add up. This leads to insurance companies paying out larger sums of money, impacting their overall profitability and, inevitably, forcing them to raise premiums. It’s a vicious cycle, if you ask me.

Geographic Vulnerability and Risk Assessment

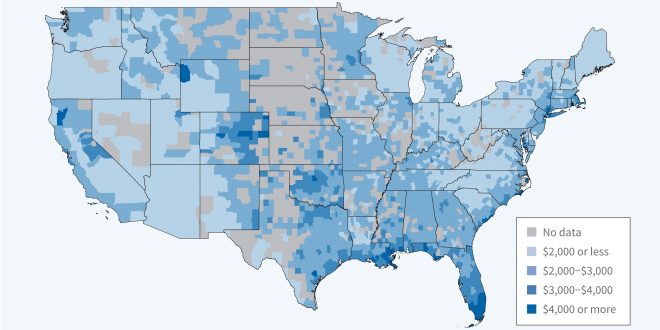

Insurers aren’t dummies; they’re carefully evaluating geographic vulnerability to natural disasters. Coastal regions prone to hurricanes, areas susceptible to wildfires, and floodplains are considered higher risk. So, you might wanna rethink that beachfront property… just sayin’. They use advanced modeling techniques to assess risk with increasing accuracy. Makes you wonder if they know something we don’t, right?

The Impact of Tariffs on Building Materials

Rising Costs of Construction Materials

Tariffs imposed on imported building materials, such as lumber, steel, and aluminum, have significantly increased the cost of construction and repairs. Remember when you could build a deck without breaking the bank? Yeah, those days are kinda gone. This directly affects the cost of rebuilding homes damaged by natural disasters.

Increased Claims Payouts

When a home is damaged and needs to be rebuilt, the increased cost of materials translates directly into higher claims payouts for insurance companies. More expensive materials? Higher insurance payouts. Higher insurance payouts? Yep, you guessed it, higher premiums. This further contributes to the upward pressure on premiums.

Supply Chain Disruptions

Tariffs can also disrupt supply chains, leading to delays and shortages of building materials. Imagine waiting months to repair your roof after a storm because there’s a lumber shortage. It’s not a pretty picture, is it? This can prolong the rebuilding process and potentially increase costs even further. Gotta love those unexpected expenses!

What Homeowners Can Do

Review Your Coverage

Regularly review your home insurance policy to ensure it adequately covers your needs, and that you understand your deductible. It’s kinda like reading the fine print – nobody wants to do it, but it’s essential. Consider increasing your coverage if necessary, especially if you live in a high-risk area. Better safe than sorry, right?

Home Improvements and Mitigation

Investing in home improvements that mitigate the risk of damage from natural disasters, such as installing storm shutters, reinforcing your roof, or improving drainage, can potentially lower your insurance premiums. Think of it as an investment that pays off in the long run. Check with your insurer about discounts for mitigation measures. You might be surprised what qualifies.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurance companies to find the best coverage at the most competitive price. Online comparison tools can be helpful in this process. It’s a bit like dating – don’t commit until you’ve seen what else is out there!

Consider a Higher Deductible

Increasing your deductible can lower your monthly premiums, but be sure you can afford to pay the higher deductible if you need to file a claim. It’s a bit of a gamble, but it could save you money in the long run. Just make sure you’re comfortable with the risk.

The Future of Home Insurance

Technological Advancements

Technological advancements, such as drone inspections and data analytics, are helping insurance companies to more accurately assess risk and process claims more efficiently. Drones checking your roof? It’s the future, baby! This may lead to more personalized pricing and potentially lower costs in the long run. Fingers crossed!

Government Regulation and Policy

Government regulation and policy decisions related to climate change, building codes, and disaster relief can significantly impact the home insurance market. Staying informed about these developments is crucial for homeowners. Keep an eye on those headlines; they could affect your wallet.

Long-Term Outlook

The combination of increasing natural disasters and rising material costs suggests that home insurance premiums are likely to continue to increase in the foreseeable future. It’s not exactly sunshine and rainbows, is it? Homeowners should take proactive steps to manage their risk and protect their financial well-being. You’ve gotta play the hand you’re dealt, right?

So, there you have it – a not-so-cheerful look at why your home insurance is probably going up. It’s a complex situation, but hopefully, now you’ve got a better handle on why it’s happening and what you can do about it. Maybe it’s time to start those home improvements, shop around for better rates, and keep an eye on those government policies. Who knows, maybe you’ll find a silver lining in all this. And hey, feel free to share your own insurance horror stories. Misery loves company, after all!

seeme

seeme