Gold prices are looking pretty shiny lately, huh? They’re continuing their climb, and you might be wondering why. Well, it all boils down to some surprisingly soft US employment numbers that came out earlier today. These figures have really stirred up the market, making folks think the Federal Reserve might start cutting interest rates sooner than previously expected. And, as you probably know, that makes gold a more attractive investment since it doesn’t offer interest payments. So, let’s dig into what’s going on and what it could mean for your portfolio.

US Employment Data Disappoints

Key Figures and Analysis

Okay, so what exactly went wrong with the employment numbers? Well, the latest report showed a significant slowdown in job creation compared to previous months. We’re talking hundreds of thousands fewer jobs than analysts were predicting. It’s the kind of miss that makes you sit up and take notice. You might be asking if it’s just a blip, or something more significant. Let’s face it, these things aren’t always cut and dried.

Which sectors are feeling the pinch? Turns out, several industries experienced notable slowdowns or even job losses. Manufacturing, retail, and maybe even some tech companies are starting to feel a bit of pressure. Some folks point to rising interest rates and inflation as potential culprits, making businesses a little hesitant to hire. It’s a tricky situation, no doubt.

Impact on Economic Growth Concerns

You know, weak employment figures aren’t just about jobs; they feed into broader worries about the economy. When companies aren’t hiring, or worse, are laying people off, it raises concerns about a potential slowdown, or, dare I say, even a recession. Nobody wants that, right?

And here’s the thing: employment is closely tied to consumer spending. If people are worried about their jobs or lose them altogether, they tend to tighten their belts. And when consumers stop spending, well, that can have a ripple effect throughout the entire economy. Are we headed for trouble? Only time will tell, but it’s definitely something to keep an eye on.

Federal Reserve Rate Cut Expectations Surge

Market Reaction to Employment Data

The market’s reaction to the weak employment data was pretty swift. The futures market, in particular, started pricing in a much higher probability of earlier and more aggressive interest rate cuts by the Federal Reserve. It’s like everyone suddenly realized the Fed might have to step in sooner than expected to prop up the economy. Did you see that coming? I’m not so sure I did.

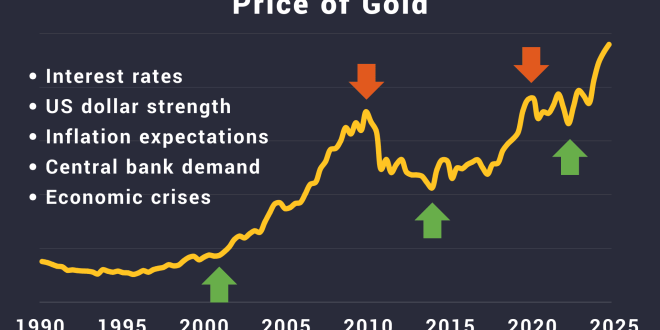

Now, why does lower interest rates make gold so appealing? Well, gold doesn’t pay any interest, right? So, when interest rates are high, bonds and other interest-bearing assets look more attractive. But when rates fall, the opportunity cost of holding gold decreases, making it a more competitive investment. It’s all about relative attractiveness, you see.

Potential Fed Response

So, what might the Federal Reserve do in response to all this? They’ve got a few options on the table. They could start cutting interest rates sooner rather than later, as the market is expecting. They could also signal a willingness to tolerate higher inflation for a bit longer to support employment. Or, they might just sit tight and see how things play out. It’s a tough call, and you can bet they’re weighing all the factors very carefully.

And don’t forget, the Fed has other tools besides interest rate cuts. They could use quantitative easing, for example, to inject liquidity into the market. Or they could try to influence expectations through their communication. It’s a bit like a magician with a whole bag of tricks, hoping to pull out the right one at the right time. Will they succeed? We can only hope so.

Gold Price Outlook

Short-Term Price Drivers

Okay, let’s talk about what could drive gold prices in the short term. Of course, upcoming economic data releases, like inflation reports and GDP figures, will be crucial. Any comments from Fed officials will also be closely scrutinized. Traders will be hanging on every word, trying to decipher the Fed’s next move.

Technical analysis can also provide some clues. Chart patterns, support and resistance levels, and momentum indicators can all offer insights into potential price movements. Of course, technical analysis is never a guarantee, but it can be a useful tool for traders. You know, sometimes it feels like reading tea leaves, doesn’t it?

Long-Term Investment Thesis for Gold

Looking beyond the short term, gold has some compelling fundamental reasons to be considered a long-term investment. It’s often seen as a safe-haven asset during times of economic uncertainty. Plus, it can act as a hedge against inflation, helping to preserve your purchasing power over time. It’s like having a little insurance policy in your portfolio.

Geopolitical risks and global macroeconomic trends can also impact the demand for gold. Wars, political instability, and currency devaluations can all drive investors towards the safety of gold. So, even if the US economy recovers, there are plenty of other factors that could keep gold prices supported. It’s a wild world out there, isn’t it?

So, there you have it. The link between weak US employment data, rising expectations for rate cuts, and the strength in gold prices seems pretty clear. Whether you’re a seasoned investor or just starting out, it’s worth considering how gold might fit into your overall portfolio. Of course, every investment comes with risks, so do your homework and consult with a financial advisor before making any decisions. But hey, who knows? Maybe a little bit of gold could add some sparkle to your financial future!

seeme

seeme