Alright, let’s dive right into what’s happening with gold, shall we? Gold is making some upward moves right now. It seems everyone’s holding their breath, waiting for the US CPI data to drop. Why’s that a big deal? Well, it’s gonna give us a peek into what the Federal Reserve might do next. And that, my friends, can seriously shake up where gold prices are headed. So, yeah, keep your eyes peeled!

XAU/USD Technical Analysis

Short-Term Momentum

Okay, so let’s peek under the hood, shall we? Looking at the short-term stuff, it seems like XAU/USD is showing some, shall we say, “oomph”. The Relative Strength Index – or RSI if you’re into abbreviations – is kinda climbing, which usually hints at more folks buying in. But, hey, don’t get too excited! We gotta watch out for when things get too “overbought.” Think of it like a stretched rubber band – it’s gotta snap back sometime, right? So, a pullback might be lurking around the corner. Just a heads-up!

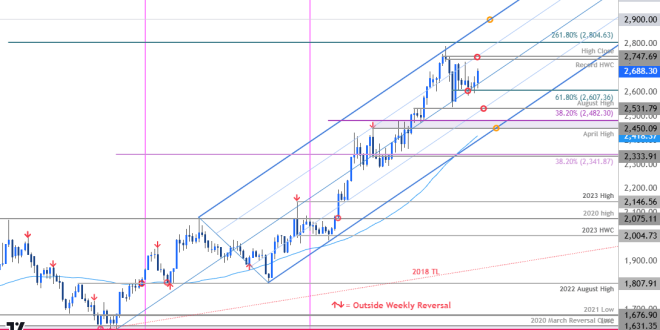

Key Support and Resistance Levels

Alright, so, where’s the line in the sand? Well, it looks like the immediate resistance is hanging around that $2050 mark. If it punches through that, we might see a run towards $2070. Fingers crossed, maybe? But on the flip side, keep an eye on $2030. That’s a key support level. And if that cracks? Ouch. We might slide down to $2015. And if we go south of that? Well, that might be a sign that the bears are taking over. And nobody wants that, do they?

Impact of US CPI Data

Inflationary Expectations

This CPI data, though…it’s a biggie. It’s like the grand reveal of how inflation’s doing. Now, if it comes in hotter than expected, that could give the US dollar a shot in the arm. And, traditionally, that’s not great news for gold. Why? Because it might mean the Fed keeps those interest rates cranked up high. We’ll have to see…

Federal Reserve’s Response

But what if the CPI data comes in cooler than we thought? Then, whoa, hold on to your hats! The dollar might take a tumble, and gold could get a boost. Why? Because it might hint that the Fed’s gonna chill out with the interest rate hikes. The market’s reaction is gonna be everything! It’s all a bit of a guessing game, isn’t it?

Factors Influencing Gold Prices

Geopolitical Risks

Let’s not forget the world’s, um, “interesting” state. All the geopolitical tensions and whatnot? Yeah, that stuff tends to make people run to gold as a safe haven. So, even if interest rates are trying to rain on gold’s parade, global jitters can give it a little umbrella. Always something to consider, right?

Dollar Strength

The dollar, though, remains a bit of a party pooper for gold. A strong dollar makes gold more expensive for anyone not holding dollars. Simple as that. So, if the dollar’s flexing, gold’s got an uphill battle. It’s like trying to run a marathon with lead boots.

Interest Rate Expectations

And, let’s be real, interest rates are the puppet master right now. As they climb, holding gold gets less appealing. Think of it this way: why hold something that doesn’t pay you anything when you could be earning interest elsewhere? It’s all about that opportunity cost, you know?

So, where does that leave you? I mean us? Well, it looks like gold’s next big move hinges on that US CPI data. Short-term, things are looking kinda bullish, but the Fed’s next move, dictated by that inflation data, will really decide which way the wind blows in the medium term. Keep your eyes peeled and your wits about you!

seeme

seeme