Gold’s price trajectory is currently caught in a tug-of-war between the potential for lower interest rates from the Federal Reserve and the ongoing uncertainty surrounding international trade negotiations. Investor sentiment remains highly sensitive to developments on both fronts, making accurate forecasting a challenging endeavor. This article will delve into the key factors influencing the gold market, analyzing the potential impact of trade talks and Fed policy on its future price movements. It’s like watching a suspense movie – will it go up, down, or just sideways? Honestly, your guess is as good as mine, but let’s dig into the details and see if we can make some sense of it all.

The Impact of Trade Negotiations on Gold Prices

You know how it is with trade negotiations, right? One minute things are looking up, the next, everyone’s back to square one. And gold, well, it tends to react to all that drama like a teenager with mood swings. It’s all about risk, isn’t it? When there’s global uncertainty, people often flock to safe-haven assets, and gold is the classic go-to. But what happens when things actually start to look, dare I say, stable?

Trade War Escalation and Safe-Haven Demand

If trade wars escalate – and let’s be real, they could – you’ll probably see increased demand for gold. Think of it as financial storm prepping. Investors get nervous, and gold suddenly looks a whole lot more appealing than, say, tech stocks or emerging market bonds. I remember during a particularly nasty trade spat a few years back, gold just kept climbing. It felt like the only thing making sense in a world gone mad! So, yeah, trade tensions? Good for gold, at least in the short term.

Trade Deal Breakthrough and Reduced Safe-Haven Appeal

Now, flip the script. Imagine a trade deal actually happening. I know, it feels like a pipe dream these days, but hey, stranger things have occurred. If that happens, expect gold to lose some of its luster. Suddenly, the world feels a little less scary, and investors might be more willing to take risks on other assets. It’s all about the perceived safety, and a trade deal would definitely dial that down a notch. Will it last? That’s a different story, but initially, gold would likely take a hit.

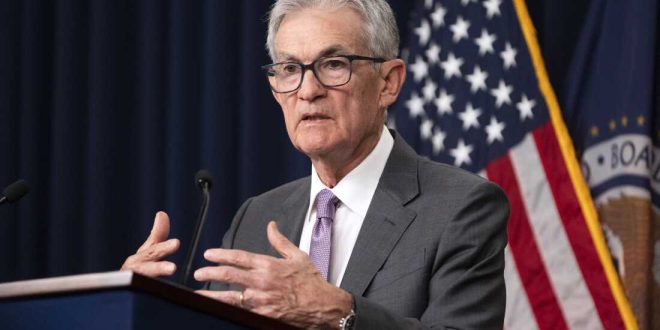

Federal Reserve Rate Cuts and Gold’s Performance

The Fed, oh, the Fed. Always keeping us on our toes. Their decisions on interest rates have a major impact on gold. It’s kind of like a see-saw: rates down, gold potentially up, and vice-versa. But it’s never quite that simple, is it? There’s always some nuance, some hidden factor lurking in the shadows, ready to mess with the equation.

Inverse Relationship Between Interest Rates and Gold

Generally speaking, gold and interest rates have an inverse relationship. Why? Because gold doesn’t pay any interest. So, when interest rates are high, you’re missing out on potential returns by holding gold. But when rates are low, or even negative, gold starts to look a lot more attractive. It’s all relative, you see. Think of it as opportunity cost – what else could you be doing with that money?

The Fed’s Stance on Inflation and Rate Decisions

The Fed’s primary mandate is to keep inflation in check. If they see inflation rising too quickly, they’re likely to raise interest rates to cool things down. But, and this is a big but, if they’re worried about economic growth, they might hesitate to raise rates, or even cut them. This balancing act is what makes predicting the gold market so darn tricky. It’s like they’re playing chess with the entire economy!

Analyzing Key Economic Indicators

Beyond trade and the Fed, there’s a whole host of economic indicators that can influence gold. We’re talking inflation data, GDP growth, employment numbers…the whole shebang. Keeping an eye on these can give you a better sense of the overall economic picture and, consequently, where gold might be headed. So get your reading glasses on, and let’s dive in!

Inflation Data and Gold’s Role as an Inflation Hedge

Gold is often touted as an inflation hedge. The idea is that as inflation erodes the value of your money, gold will hold its value, or even increase. And there’s some truth to that. Historically, gold has performed well during periods of high inflation. But it’s not a perfect correlation. Sometimes, gold just does its own thing, regardless of what inflation is doing. It’s a bit of a rebel, really.

GDP Growth and its Influence on Monetary Policy

GDP growth is another key indicator. Strong GDP growth usually leads to higher interest rates, which, as we discussed, can be negative for gold. Conversely, weak GDP growth might prompt the Fed to lower rates, which could boost gold. It’s all interconnected. The economic gears are turning, and gold is reacting to them. It’s a complicated dance, isn’t it?

Expert Opinions and Market Forecasts

What are the “experts” saying? Honestly, their opinions are all over the map. Some are predicting a gold boom, while others are warning of a potential crash. It’s enough to make your head spin! The truth is, no one really knows for sure. But listening to different perspectives can help you form your own informed opinion. Just don’t take anyone’s word as gospel.

Analyst Sentiment on Gold’s Potential

You’ll find analysts on both sides of the fence. Some are bullish, citing ongoing global uncertainties and the potential for further Fed rate cuts. Others are bearish, pointing to the possibility of a trade deal and stronger-than-expected economic growth. The key is to weigh the arguments and decide which scenario you find more plausible. Think of it as being a judge in a financial courtroom.

Identifying Potential Risks and Opportunities

What are the potential risks and opportunities in the gold market? Risks include a surprise resolution to the trade war, a sudden spike in interest rates, or a general loss of investor confidence in gold. Opportunities include further trade tensions, a dovish Fed policy shift, or a renewed surge in inflation. Identifying these potential scenarios can help you make informed investment decisions. It’s all about being prepared for whatever the future may hold.

Ultimately, the future of gold prices hinges on a complex interplay of factors, including the direction of international trade negotiations and the Federal Reserve’s monetary policy decisions. Keeping a close watch on these developments and considering various expert opinions will equip you with the knowledge to navigate the uncertainties and potential opportunities in the gold market. And who knows, maybe you’ll strike gold. Or maybe you’ll just learn something new. Either way, it’s an interesting ride! Don’t just take my word for it, though; keep an eye on those headlines and maybe dabble a bit with your own research. You might just find your own golden nugget of insight!

seeme

seeme