Gold has seen a remarkable surge in value over the past six years, effectively doubling its price. This impressive performance has naturally sparked considerable interest and speculation about its future trajectory. Investors and analysts alike are now keenly focused on forecasting just how high gold prices could climb in the next five years, considering factors ranging from global economic uncertainty to geopolitical instability. It’s a hot topic, and honestly, who isn’t curious about whether they should be adding a little gold to their portfolio these days?

Understanding the Recent Gold Price Surge

Factors Driving the Price Increase

So, what’s been fueling this golden gallop? Well, a bunch of things, really. Inflation’s been a persistent worry, hasn’t it? People get nervous about their money losing value, and gold suddenly looks mighty appealing. Then you’ve got all the geopolitical risks – wars, political upheavals, the usual suspects. Makes folks run for safe-haven assets, and gold’s always been a favorite in that category. And let’s not forget the US dollar. When it weakens, gold tends to shine even brighter. Oh, and the central banks? They’ve been quietly adding to their gold reserves too. Plus, emerging markets like India and China just can’t seem to get enough of the stuff. It’s a potent cocktail, wouldn’t you agree?

Historical Performance and Trends

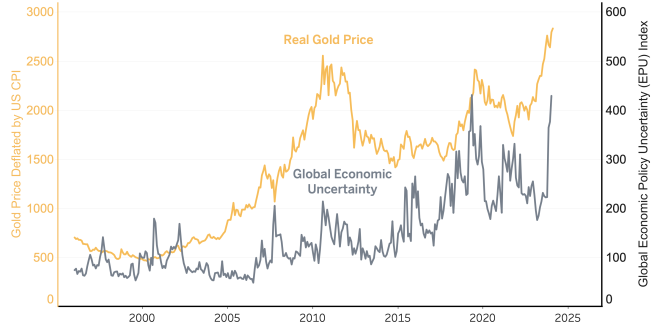

To get a grip on where gold might be headed, it helps to peek into its past. If you look at historical gold price data, you can see some pretty interesting patterns. Like, back in the 70s, when inflation went wild, gold went nuts. And during the 2008 financial crisis? Same story. Now, the million-dollar question: are we in a similar situation now? Are there echoes of past booms that could give us a hint? I mean, history doesn’t repeat itself, but it often rhymes, right?

Future Price Projections: Expert Opinions

Bullish Scenarios

Okay, let’s talk about the pie-in-the-sky scenarios, the “gold to the moon” predictions. Some analysts are really bullish, thinking we could see gold prices reach, well, let’s just say some eye-watering levels. They argue that if inflation stays stubbornly high, or if there’s a major geopolitical crisis, gold could easily break records. I’ve heard some folks throwing around numbers like $3,000, even $4,000 an ounce in the next five years! Wild, right? They usually point to things like increased investor demand and continued central bank buying as the main drivers. Fingers crossed, I guess?

Bearish Scenarios

Now for the cold shower. Not everyone’s convinced the gold party will continue. There are plenty of analysts who think that gold’s price appreciation could be limited, or even that we could see a correction. They might say that if interest rates keep rising, or if the global economy stages a strong recovery, gold’s appeal could fade. Some are even predicting a drop back down to, say, $1,800 or even lower. Makes you think, doesn’t it?

Base Case Projections

Alright, let’s dial down the drama and look at a more reasonable scenario. Most experts seem to think that gold prices will likely continue to rise, but at a more moderate pace. They’re forecasting something in the range of $2,300 to $2,800 an ounce in the next five years. This base case assumes that inflation will gradually come under control, and that the global economy will muddle along without any major crises. It’s the boring option, maybe, but probably the most realistic.

Factors Influencing Gold Prices in the Next 5 Years

Economic Conditions

The global economic climate is a huge piece of this puzzle. Will we see strong economic growth? Will inflation stay high, or will central banks finally get it under control? What about interest rates? And how will currency fluctuations affect things? All these factors can have a big impact on gold prices. If the economy tanks, gold could soar. If things look rosy, it might take a breather. It’s all connected, see?

Geopolitical Events

Geopolitics – that’s the wild card. A major conflict, a trade war, political instability in a key region…any of these could send investors scrambling for gold. Predicting these events is, well, next to impossible. But it’s something you’ve got to keep in the back of your mind. It’s like that old saying: “Cometh the hour, cometh the gold.” Or something like that.

Central Bank Policies

Don’t forget about the central banks. They’re the big players in the gold market, and their actions can have a significant impact on prices. If they keep buying gold, that’ll push prices higher. If they start selling, well, you can guess what’ll happen. Also, their interest rate policies can affect the attractiveness of gold relative to other investments. Tricky stuff, indeed.

Investment Demand

And then there’s just plain old investment demand. Are people buying gold ETFs? Are institutional investors loading up on gold futures? Are individual investors hoarding gold coins? The more demand there is, the higher prices will go. Keeping an eye on these trends can give you a sense of where things are headed.

Investment Strategies: Is Gold Right for You?

Assessing Your Risk Tolerance

Before you jump on the gold bandwagon, take a good, hard look at your own risk tolerance. Are you the kind of person who can stomach big swings in the value of your investments? Or do you prefer something a little more stable? Gold can be volatile, so it’s not for everyone. It’s better to know your limits beforehand, trust me.

Diversifying Your Portfolio with Gold

One of the main reasons people invest in gold is to diversify their portfolios. Gold tends to perform well when other assets, like stocks and bonds, are struggling. So, adding a little gold to your mix can help to reduce your overall risk. Think of it as a safety net, or maybe a shiny, golden parachute.

Different Ways to Invest in Gold

There are lots of ways to get your hands on some gold. You can buy physical gold – bars or coins. You can invest in gold ETFs, which track the price of gold. You can buy shares in gold mining companies. Or you can trade gold futures contracts. Each option has its own pros and cons, so do your homework before you dive in. It’s like choosing the right tool for the job.

Ultimately, forecasting the future of gold prices is a tricky business. There are so many factors that can influence its performance. But by understanding these factors and considering different scenarios, you can make informed decisions about whether or not to add gold to your investment portfolio. Whether gold continues its meteoric rise or settles into a more modest climb, being well-informed is your best bet. Why not start exploring and see if a bit of gold aligns with your financial goals? Who knows, maybe it’s the treasure you’ve been searching for!

seeme

seeme