Gold has always been that reliable friend, hasn’t it? You know, the one you can always count on when things get a little dicey. And, boy, has it been performing! Over the past year, the price of gold has been making headlines, and for good reason. We’re going to dive into why it’s been on such a tear, what it means for you and the rest of the world, and maybe even peek into what the future might hold for this shiny metal.

Key Drivers of the Gold Price Increase

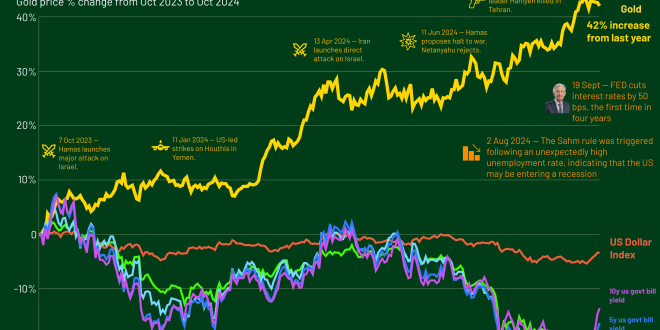

Geopolitical Instability

You turn on the news, and it feels like there’s always some kind of conflict brewing, right? All this geopolitical tension? It’s not just background noise; it’s a major reason why gold’s been doing so well. When the world feels shaky, investors tend to flock to safe-haven assets, and gold is pretty much the poster child for “safe haven.” It’s like everyone’s thinking, “Okay, things are crazy, better park my money somewhere it won’t disappear overnight.” I mean, who can blame them?

Economic Uncertainty and Inflation

Ah, inflation, that word we’re all tired of hearing. But it’s a big deal, especially when you’re trying to figure out where to put your hard-earned cash. With inflation eating away at the value of your savings, and whispers of a recession floating around, gold starts to look pretty appealing. It’s seen as a way to preserve wealth when traditional investments might be taking a hit. Makes you wonder if we should all have a little gold stashed under our mattresses, doesn’t it?

Interest Rate Policies

Now, let’s talk interest rates. What the central banks decide to do with interest rates can really send ripples through the gold market. When interest rates are low, gold tends to shine, because the opportunity cost of holding it (you know, not earning interest) is lower. All eyes are usually on the U.S. Federal Reserve because their decisions have a global impact. It’s like watching a complicated chess game, except the pieces are dollars and gold bars.

Dollar Weakness

Here’s a fun fact: the U.S. dollar and gold often move in opposite directions. So, when the dollar weakens, gold gets a boost. Why? Because gold is priced in dollars, so a weaker dollar makes gold cheaper for buyers using other currencies. It’s like a built-in discount! I guess it’s just one of those quirky economic relationships you learn to expect.

Increased Investor Demand

It’s not just individual investors like you and me who are snapping up gold. Big institutional investors are also getting in on the action. Even central banks have been increasing their gold reserves. When you see that kind of widespread demand, it’s bound to push prices higher. Makes you wonder what they know that we don’t, huh?

Impact of the Gold Price Increase

Impact on Investors

So, how does all this affect you, the investor? Well, if you’ve been holding gold, you’re probably feeling pretty good right now. But it depends on your strategy. Are you in it for the long haul, or are you looking to make a quick buck? The rise in gold prices has different implications for different folks, from the average Joe to big hedge fund managers. It’s all about perspective, really.

Impact on the Global Economy

Gold isn’t just an investment; it’s also a barometer of economic health. Rising gold prices can influence everything from inflation rates to currency values. And for countries that are big gold producers, like South Africa or Australia, a price surge can be a major economic boon. It’s like a golden goose laying bigger eggs, if you will. But remember it affects the global economy, for better or worse.

Impact on Gold Mining Companies

You know who’s really happy about all this? Gold mining companies! Higher prices mean bigger profits, which can lead to increased exploration and production. But it also puts pressure on them to be responsible and sustainable in their mining practices. After all, nobody wants a gold rush that comes at the expense of the environment or local communities. You can’t eat gold, so….

Future Trends and Predictions

Potential Future Drivers

What’s next for gold? Well, if geopolitical tensions continue to simmer, and economic uncertainty remains, gold could keep its shine. Keep an eye on those factors, as well as any big shifts in central bank policies. The world is constantly changing, so it’s crucial to stay informed. Don’t take my word for it.

Expert Opinions and Forecasts

What do the experts say? Well, forecasts vary, as they always do. Some analysts believe gold will continue its upward trajectory, while others predict a correction. It’s a mixed bag of opinions, so take everything with a grain of salt and do your own research. After all, no one has a crystal ball. If they did, they’d probably be too busy buying lottery tickets!

Investment Strategies Moving Forward

So, what should you do with all this information? Maybe consider diversifying your portfolio, but don’t go throwing all your eggs in one golden basket. Think about your risk tolerance and long-term financial goals. And remember, past performance is no guarantee of future results. It’s always a gamble, but it doesn’t hurt to be prepared.

So, there you have it. Gold’s wild ride over the past year, the reasons behind it, and a little food for thought about what might be coming next. Whether you’re a seasoned investor or just curious about the markets, it’s always good to stay informed. Maybe it’s time to consider adding a little gold to your portfolio. Or maybe you should just keep an eye on the headlines and see how things play out. Either way, good luck and happy investing!

seeme

seeme