Gold prices are always a hot topic, especially in times of economic uncertainty. As we head into June, investors and analysts alike are closely monitoring market trends to anticipate potential movements in the price of gold. This article will provide a forecast for gold prices in June, taking into account various factors influencing the market, and offer key information to help you make informed decisions.

Factors Influencing Gold Prices in June

Interest Rates and Monetary Policy

You know, it’s kinda wild how much central banks influence everything, right? Especially gold. When interest rates, like those set by the Federal Reserve, potentially change, it sends ripples through the gold market. See, gold doesn’t pay interest, so when interest rates are high, things like bonds look more attractive. It’s an inverse relationship – higher rates, potentially lower gold prices, and vice versa. Makes sense, doesn’t it? It’s all about where investors see the best return. I mean, if you could get a guaranteed high return somewhere else, why bother with gold, right?

Inflation and Economic Data

Inflation reports – oh boy, do they move markets! If inflation is running hot, people start looking for ways to protect their wealth, and gold often becomes the go-to hedge. Key economic data releases can really stir things up, too. Keep an eye out for those reports in June. What consumer price index will be? Producer price index? These numbers give a snapshot of the economy’s health, and they influence the demand for gold. Honestly, sometimes it feels like we’re all just guessing, but informed guesses, hopefully!

Geopolitical Events and Uncertainty

Okay, let’s talk about the big, scary stuff. Global political instability, conflicts, trade tensions… these things are like rocket fuel for gold prices. When the world feels uncertain, investors flock to safe-haven assets, and gold is the classic choice. Think of it like this: if there’s chaos in the streets, people buy gold. I’m not saying there will be chaos, but it’s something to keep in mind! Keep your eyes peeled for any potential geopolitical events that could spook the market. A little bit of worry goes a long way when it comes to precious metals.

Currency Fluctuations

Here’s a fun one: the US dollar and gold. They’re like frenemies, always impacting each other. Since gold is often priced in US dollars, a weaker dollar can make gold more attractive to buyers holding other currencies, potentially driving the price up. Conversely, a stronger dollar can make gold more expensive for those same buyers, potentially pushing the price down. It’s all relative, you see? So, keep an eye on the dollar’s performance – it’s a crucial piece of the puzzle.

Gold Price Forecast for June

Bullish Scenario

Alright, let’s imagine a world where everything’s going gold’s way. High inflation sticks around like that one houseguest who just won’t leave, geopolitical tensions flare up all over the place, and interest rates stay low. In this scenario, you could see gold prices pushing higher, maybe even testing new highs. We could be looking at a price range of, say, $2,450 to $2,550 per ounce. But hey, that’s just one possible future, right?

Bearish Scenario

Now, let’s flip the script. Imagine the economy suddenly starts booming, interest rates rise faster than expected, and the US dollar becomes super strong. In that case, gold might face some serious headwinds. People might start ditching gold for riskier assets offering higher returns. We could see gold prices dipping down to, maybe, $2,200 to $2,300 per ounce. Nobody wants that, but it’s good to be prepared, just in case.

Base Case Scenario

Okay, let’s be realistic here. The most likely scenario is somewhere in the middle. We’ll probably see a mix of positive and negative factors influencing gold prices. Maybe some inflation, but not too much. Some geopolitical worries, but nothing catastrophic. Interest rates might inch up, but slowly. In this base case, I’d say a likely price range for gold in June would be around $2,300 to $2,400 per ounce. That feels… reasonable, doesn’t it?

Key Information for Gold Investors

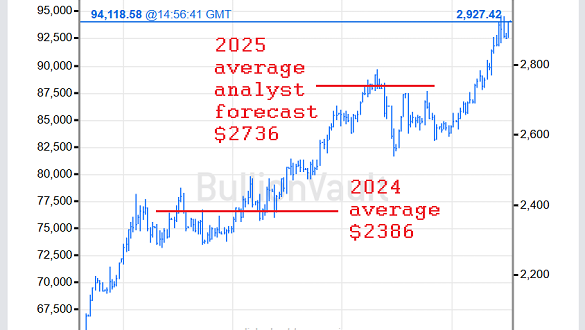

Technical Analysis and Charts

Don’t get scared off by the jargon! Technical analysis is just a fancy way of looking at charts and trying to predict future price movements. Investors use things like support and resistance levels, moving averages, and other indicators to get a sense of where gold prices might be headed. You can find this information on financial websites, maybe give it a look? It’s not foolproof, but it can give you an edge. Currently, potential support levels might be around $2,280, while resistance could be near $2,420. But markets change fast, so stay updated!

Physical Gold vs. Gold ETFs

So, you wanna invest in gold, huh? Great! But how? You’ve got a couple of options: physical gold (like bars or coins) or gold ETFs (Exchange Traded Funds). Physical gold is cool, but you gotta store it somewhere safe. ETFs are more liquid and easier to trade, but you don’t actually own the gold. Think about it. Do you wanna hold it in your hand, or just see it on a screen? Consider the storage costs, liquidity, and fees associated with each option, and pick what fits your style and budget.

Risk Management Strategies

Investing in anything involves risk, gold included. Don’t go throwing your life savings into it, okay? Diversifying your portfolio is always a good idea – don’t put all your eggs in one golden basket. Consider setting stop-loss orders to limit your potential losses, and make sure you understand your own risk tolerance. If you’re gonna lose sleep over every little price fluctuation, maybe gold isn’t for you. Be smart, be careful, and don’t invest more than you can afford to lose. Easier said than done, I know.

So, there you have it: a look at what might influence the price of gold in June. Interest rates, inflation, global events, currency fluctuations – it all plays a part. Stay informed, do your research, and remember that no one can predict the future with certainty. Whether you decide to invest in physical gold or gold ETFs, make sure it aligns with your investment goals and risk tolerance. Good luck, and may your investments be golden! Maybe we’ll all get lucky and strike gold, eh?

seeme

seeme