Gold! It’s shiny, it’s valuable, and for ages, it’s been that “just in case” asset everyone talks about when the economy looks shaky. And let’s face it, with whispers of a recession getting louder, you might be wondering if stocking up on gold is a smart move. Should you dive in headfirst, or is it just fool’s gold? We’ll break down the good, the bad, and the glittering so you can decide if adding some gold to your portfolio makes sense for you.

Why Gold is Considered a Safe Haven

So, why all the hype around gold when things get tough? Well, it boils down to a few key reasons. It’s not just because pirates loved it, though that definitely adds to the mystique!

Historical Performance During Recessions

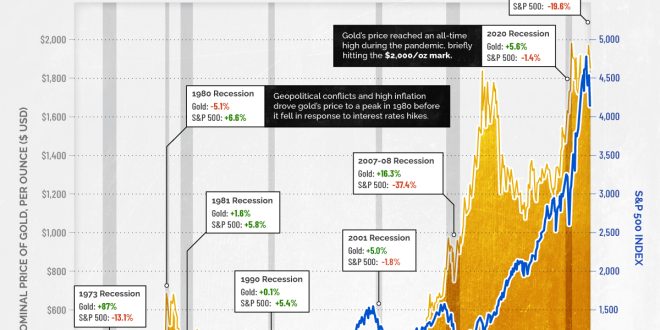

Historically, gold has often performed well during recessions. When stocks take a nosedive and the housing market sputters, investors tend to run to gold as a safe haven. I mean, who wouldn’t want something solid when everything else feels like quicksand? This increased demand can drive up its price. But remember, past performance doesn’t guarantee future results. It’s more like a guideline, not a crystal ball.

Inflation Hedge Properties of Gold

Inflation is like that annoying houseguest that just won’t leave. Gold is often seen as a hedge against it. The idea is that as the value of currency decreases, the price of gold tends to increase, preserving your purchasing power. It’s like having a lifeboat when your money’s boat starts sinking. Does it always work perfectly? Nope. But it’s a comforting thought, right?

Demand and Supply Dynamics in Economic Downturns

During economic downturns, the demand for gold often increases due to the factors we’ve already discussed. At the same time, the supply of gold is relatively limited. You can’t just print more gold like you can with money (believe me, I’ve checked). This imbalance between supply and demand can further support gold prices. Basic economics, folks!

Different Ways to Invest in Gold

Okay, so you’re intrigued. Now what? Luckily, there are several ways to get your hands on the golden stuff.

Physical Gold: Bullion, Coins, and Jewelry

This is the classic way. You can buy gold bars (bullion), coins, or even jewelry. There’s something undeniably cool about holding a solid gold bar, right? But remember, you’ll need to store it safely, which could mean a safe deposit box and extra costs. And, let’s be honest, wearing a giant gold chain might not be the most subtle investment strategy.

Gold ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) and mutual funds that focus on gold are a more convenient way to invest. You’re not actually holding physical gold, but you’re investing in a fund that tracks its price. It’s like having a piece of the pie without having to bake it yourself. Easier to manage, easier to sell, but you don’t get the pirate-y feeling of owning actual gold.

Gold Mining Stocks

Investing in companies that mine gold is another option. If the price of gold goes up, these companies, in theory, should become more profitable. But, you’re also exposed to the risks of the mining industry itself, like environmental regulations, labor disputes, and the occasional goblin attack… Okay, maybe not goblins. But still, more risks to consider.

Gold Futures and Options

These are more complex instruments that allow you to bet on the future price of gold. Honestly, this is for experienced investors who know what they’re doing. If you’re just starting out, maybe stick to the simpler options. Think of it like this: futures and options are like playing chess, while buying physical gold is like playing checkers. Both can be fun, but one requires a lot more strategy.

Pros and Cons of Investing in Gold During a Recession

Alright, let’s weigh the shiny stuff against the not-so-shiny.

Advantages: Diversification, Preservation of Capital, Potential for Appreciation

Gold can diversify your portfolio, meaning you’re not putting all your eggs in one basket. It can also help preserve your capital during economic turmoil, as its value tends to hold up better than other assets. And, if you’re lucky, the price might even go up! A triple win, hopefully.

Disadvantages: No Income Generation, Storage Costs for Physical Gold, Market Volatility

Unlike stocks or bonds, gold doesn’t generate income. It just sits there, being gold. If you’re holding physical gold, you’ll need to pay for storage. And, despite its reputation as a safe haven, the price of gold can still be volatile. It’s not a magic shield against all financial woes.

Strategies for Gold Investments in a Recessionary Environment

If you decide to invest, here are a few strategies to consider.

Dollar-Cost Averaging

This involves investing a fixed amount of money in gold at regular intervals, regardless of the price. This helps to smooth out the impact of price fluctuations. It’s like wading into the pool slowly instead of diving in headfirst.

Diversifying Gold Investments

Don’t put all your golden eggs in one basket. Spread your investments across different types of gold assets, like ETFs, mining stocks, and maybe even a gold coin or two for fun.

Monitoring Economic Indicators and Market Trends

Keep an eye on what’s happening in the economy and the market. This will help you make informed decisions about when to buy, sell, or hold your gold investments. It’s like being a weather forecaster for your own financial future.

Risks Associated with Gold Investments

Let’s be real, investing in gold isn’t all sunshine and rainbows.

Price Volatility

Even though it’s considered a safe haven, gold prices can still fluctuate significantly. Don’t expect it to be a completely smooth ride. Be prepared for some bumps along the way.

Counterparty Risk (Especially with Derivatives)

When dealing with gold futures or options, there’s always the risk that the other party won’t fulfill their obligations. It’s like betting on a horse race – sometimes the horse just doesn’t run as expected.

Storage and Security Concerns

If you’re holding physical gold, you need to worry about storing it safely and securely. This could involve renting a safe deposit box or investing in a home safe. And nobody wants to become a real-life pirate target.

Alternatives to Gold During a Recession

Gold isn’t the only game in town. There are other assets that investors often turn to during recessions.

Treasury Bonds

These are considered very safe investments, as they’re backed by the government. They might not offer huge returns, but they’re generally reliable. Think of them as the steady Eddie of the investment world.

Dividend-Paying Stocks

Companies that consistently pay dividends can provide a stream of income, even during a recession. It’s like getting paid to wait out the storm.

Real Estate

While the real estate market can be affected by recessions, well-chosen properties can still hold their value and provide rental income. Location, location, location! And a bit of luck, of course.

Investing in gold during a recession? It could be a smart move to protect your investments, but it’s not a guaranteed win. Make sure you know the ins and outs before you dive in. Think about your own comfort level with risk, what you’re hoping to achieve, and what the overall economy is doing. Maybe chat with a financial advisor too! And hey, whatever you decide, good luck out there!

seeme

seeme