Gold demand in the second quarter of 2025 presents a complex picture, influenced by factors ranging from central bank policies and inflation rates to technological advancements and consumer sentiment. This report delves into the key drivers behind these trends, offering a comprehensive analysis of the current market landscape and potential future directions. Buckle up, it’s going to be a golden ride!

Global Gold Demand Overview

Total Demand Figures and Percentage Changes

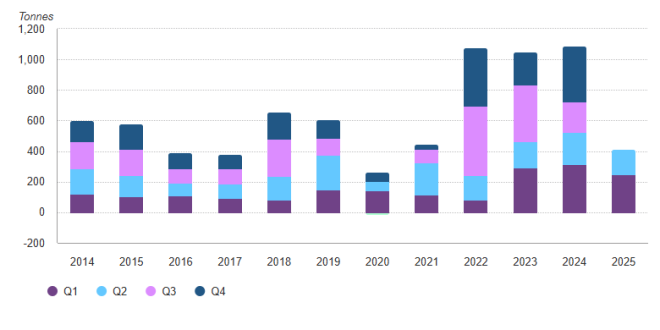

So, how did gold fare in the second quarter of 2025? Well, total demand saw some interesting shifts. You’ll notice a % change compared to last year, and honestly, predicting these things is like reading tea leaves sometimes. Did we see an uptick? A dip? Or did things just… hover? It’s all about those little economic wiggles, isn’t it?

Demand Breakdown by Sector (Jewelry, Technology, Investment, Central Banks)

Let’s slice and dice this golden pie, shall we? Jewelry’s always a big piece, right? But tech’s quietly sneaking up with its need for gold in electronics. Investment demand can be a rollercoaster, depending on what the stock market is doing. And then you’ve got the central banks, those big players who can really move the market. Last quarter, I think jewelry took a slight hit, maybe people are buying experiences rather than things? Or maybe it’s just me projecting my travel bug onto global economics. Who knows!

Regional Variations in Demand

Gold demand isn’t one-size-fits-all, not at all. What’s hot in Asia might be lukewarm in Europe. And North America? Well, they’re usually doing their own thing anyway. You’ve gotta look at cultural preferences, economic stability, and even seasonal trends to really understand what’s going on. I remember reading about how gold is super popular for weddings in India; things like that really skew the numbers, you know?

Key Drivers of Demand

Impact of Inflation and Interest Rates

Ah, inflation and interest rates, the classic economic dance! When inflation rears its ugly head, people often flock to gold as a safe haven. Makes sense, right? But then the interest rates start climbing, and suddenly bonds look a bit more tempting. It’s a push and pull, always keeping you on your toes. It’s like trying to decide between pizza and tacos; both are good, but which one right now?

Central Bank Gold Reserves and Purchasing Trends

Central banks are like the whales of the gold market. When they start buying, everyone notices. Are they stocking up to hedge against economic uncertainty? Or are they just diversifying their reserves? Whatever their reasons, their moves send ripples through the entire market. I always imagine them in some sort of high-stakes poker game, except the chips are gold bars.

Geopolitical Influences on Gold Demand

You know, the world is a bit of a chaotic place, isn’t it? Geopolitical tensions, trade wars, political instability—all of it can send investors running to the perceived safety of gold. It’s like when the weather gets rough, you want something solid to hold onto. Does that make sense? I hope so.

The Role of Technology in Gold Usage

Gold isn’t just for jewelry and bullion anymore. Tech companies use it in everything from smartphones to satellites. I mean, it’s a great conductor, doesn’t corrode easily… It’s the rockstar of the periodic table, honestly. As our reliance on technology grows, so too does the demand for gold. Who would’ve thought your phone was secretly hoarding precious metals?

Supply-Side Dynamics

Gold Mining Production and Output

Where does all this gold come from, anyway? From the earth, obviously! But gold mining production can be a bit unpredictable. New mines open, old mines get tapped out, and environmental regulations can throw a wrench into things. It’s a complex industry, and the supply side definitely impacts prices.

Recycled Gold Supply and Its Impact

Don’t forget about recycled gold! That old jewelry you never wear? It can be melted down and turned into something new. Recycling helps meet demand and can soften the impact of mining on the environment. Plus, it’s kind of cool to think your great-aunt’s necklace might live on as part of a new gadget, isn’t it?

New Discoveries and Exploration Efforts

The hunt for gold is never truly over. Exploration companies are always out there, searching for the next big strike. New discoveries can boost supply and potentially lower prices, but they’re also risky ventures. It’s like searching for a needle in a haystack, except the needle is made of shiny, yellow metal.

Investment Demand Analysis

Gold ETFs and Similar Investment Products

Want to invest in gold without actually buying bars? Gold ETFs (Exchange Traded Funds) are a popular option. They track the price of gold and allow you to trade it like a stock. Easy peasy, right? But, like any investment, there are risks involved. So, you gotta do your homework first!

Individual Investor Sentiment and Behavior

What are ordinary folks like you and me doing with gold? Are we buying it as a hedge against inflation? Are we panic-selling when the market dips? Our collective sentiment can have a big impact on gold prices. It’s kind of a herd mentality thing, isn’t it?

Impact of Cryptocurrency and Alternative Investments

Cryptocurrencies have definitely shaken things up in the investment world. Are they stealing gold’s thunder as a safe-haven asset? Some people think so. Others argue that gold and crypto can coexist. It’s the ultimate showdown: Old school vs. new school, gold vs. Bitcoin. Who will win?

Future Outlook and Projections

Forecasts for Gold Demand in the Next Quarter/Year

Okay, so what does the future hold? Are we headed for a golden age, or are we about to see a downturn? Experts are making predictions, but honestly, it’s all just educated guesswork. The world is constantly changing, and the gold market is no exception. I’d say, expect the unexpected.

Potential Risks and Opportunities

There are always risks and opportunities in the gold market. Economic recessions, political instability, technological breakthroughs—all of these things can impact demand. Knowing the playing field helps you make smart decisions. Keep your eyes open, and your wits about you.

Long-Term Trends Shaping the Gold Market

Looking ahead, several long-term trends could shape the market. Increasing demand from emerging markets, the growing use of gold in technology, and concerns about inflation are all factors to watch. It’s like watching a slow-motion chess game; every move counts.

So, there you have it. Gold demand is a fascinating beast, influenced by a whole host of factors. From central banks to tech companies to your average investor, everyone plays a part. Whether you’re thinking of investing in gold or just curious about the market, I hope this has been helpful. Now, go forth and make some golden decisions!

seeme

seeme