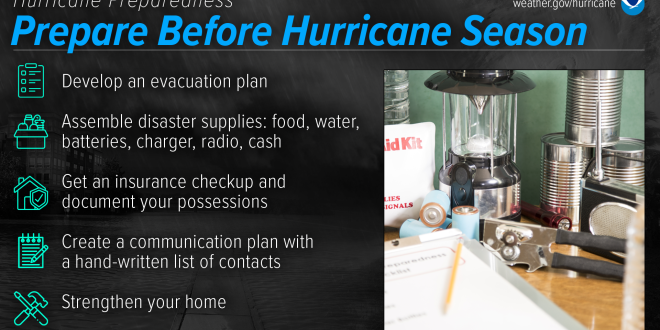

Documenting your belongings for home insurance might seem like a chore, but it’s a crucial step, especially as we approach the peak of hurricane season. A detailed record can significantly streamline the claims process if the unthinkable happens. Don’t wait until after a storm; take action now to protect yourself and your assets. This article will guide you through the essential steps to effectively document your belongings and prepare for potential insurance claims. Seriously, it’s one of those things you’ll thank yourself for later, right?

Why Documenting Your Home’s Contents is Important

Faster Claims Processing

Having a comprehensive inventory readily available speeds up the claims process. Insurers can more accurately assess your losses and reimburse you faster. Imagine trying to remember every single thing you own after a disaster. Stressful, right? A good inventory takes that off your plate.

Accurate Loss Assessment

Relying on memory after a disaster is difficult. A detailed record ensures you don’t forget valuable items and accurately represent your losses. I mean, let’s be real, who can remember everything they own off the top of their head? Especially when you’re dealing with, you know, everything going wrong.

Proof of Ownership

Documentation serves as proof of ownership, which is vital for recovering the full value of your insured items. It’s like saying, “Hey, this is mine, I can prove it!” rather than just hoping they believe you, right?

What to Document

Detailed Inventory List

Create a room-by-room inventory list, noting each item’s description, estimated value, and purchase date (if known). Focus on high-value items but also include everyday belongings. Don’t just think about the big stuff, like TVs and furniture. Think about the smaller things that add up, too. Like, your favorite coffee mugs (RIP to my “World’s Best Boss” mug from 2010).

Photos and Videos

Capture visual evidence of your belongings. Take photos or videos of each room, focusing on furniture, electronics, artwork, and other valuable items. Open drawers and closets to showcase their contents. It’s like giving your insurance company a virtual tour of your home. Plus, who doesn’t love a good before-and-after, even if it’s just for your own records?

Receipts and Appraisals

Gather and organize receipts, appraisals, and any other documentation that supports the value of your possessions. Keep these documents in a safe and accessible location, ideally off-site or in a waterproof container. I know, I know, paperwork is the worst. But trust me, future you will be so grateful you took the time to do this. Maybe treat yourself to something nice afterward? You deserve it.

How to Document Effectively

Use a Spreadsheet or App

Consider using a spreadsheet program or a dedicated home inventory app to organize your documentation. These tools can simplify the process and make it easier to update your inventory regularly. There are some really slick apps out there these days that make the whole process almost… enjoyable? Okay, maybe not enjoyable, but definitely less painful.

Regular Updates

Update your inventory regularly, especially after making significant purchases or home improvements. Add new items, remove items you no longer own, and adjust values as needed. Think of it as spring cleaning for your insurance documentation. A little bit of maintenance goes a long way, you know?

Secure Storage

Store your documentation in a secure and accessible location, such as a cloud storage service, a fireproof safe, or a safe deposit box. Ensure family members know where to find the documentation in case of an emergency. Don’t just stick it on a USB drive and then forget where you put it. Speaking from experience here…

After a Disaster

Contact Your Insurance Company Immediately

Notify your insurance company as soon as possible after a disaster. Provide them with your policy number and a brief description of the damage. The sooner you get the ball rolling, the better. Plus, it’s one less thing to worry about in the midst of everything else.

Provide Your Documentation

Submit your documented inventory, photos, videos, and receipts to your insurance adjuster. This will help them assess your claim accurately and efficiently. This is where all your hard work pays off. You’ve got everything they need, right at your fingertips. Gold star for you!

Document the Damage

Before discarding any damaged items, take photos or videos of the damage. This will provide additional evidence for your claim. It might feel a bit morbid, but it’s important to document everything before you start cleaning up. Think of it as crime scene investigation, but for your living room. Okay, maybe not that dramatic, but you get the idea.

So, there you have it. Documenting your belongings for home insurance isn’t exactly a party, but it’s a small investment of time that can save you a whole lot of headache down the road. Get those photos snapped, those lists compiled, and those receipts organized. You’ll sleep better knowing you’re prepared, and honestly, peace of mind is priceless, don’t you think? Maybe share some organizing tips if you got any!

seeme

seeme