The price of gold took a bit of a tumble today, actually a 2% drop, after news broke about a potential trade agreement between the US and China. It seems like that glint of safe-haven appeal that gold usually has just wasn’t so shiny this time around, as investors started eyeing up those riskier assets, all hyped up about possible global economic growth. Who knows if this deal is really gonna stick, but for now, it’s definitely made folks a little less jittery.

Market Reaction to the Trade Agreement

Immediate Impact on Gold Futures

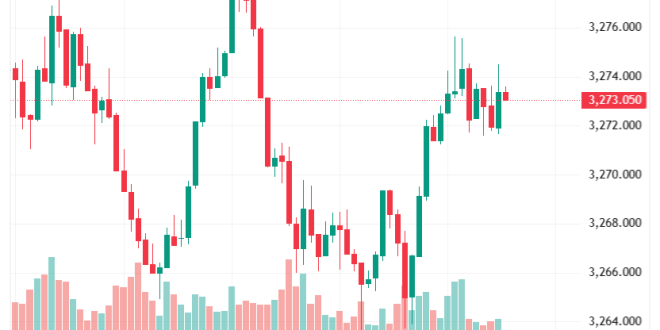

Gold futures really felt the pinch right after the US-China trade agreement was announced. You’ve got to remember, a lot of trading nowadays is done by computers – algorithms, they call ’em. So, when big news like this hits, they react super fast. It’s like someone flipped a switch, and bam, sell-off time!

Impact on Spot Gold Prices

And it wasn’t just the futures market feeling the heat. Spot prices also took a dive, pretty much mirroring what happened with the futures. I mean, if everyone’s suddenly thinking “risk-on,” who needs gold sitting in a vault? Less demand means those prices are gonna go south, right?

Factors Contributing to the Price Decline

Reduced Safe-Haven Demand

Gold, you see, it’s the old reliable friend you turn to when things get scary. Economic meltdown? Political turmoil? That’s when gold shines. But this US-China agreement? It’s like a little ray of sunshine peeking through the clouds. Suddenly, the world doesn’t seem quite so terrifying, and nobody needs a security blanket made of gold bars.

Strengthening US Dollar

Here’s another piece of the puzzle: the US dollar. When positive news drops – like this trade agreement – the dollar often gets a boost. Now, since gold is priced in dollars, a stronger dollar makes it more expensive for anyone using, say, Euros or Yen to buy gold. It’s like the price just went up for them, even though the ‘actual’ price hasn’t really changed. Kinda sneaky, huh?

Rise in Equity Markets

And let’s not forget the stock market! With all this optimism floating around thanks to the trade deal, folks started throwing money at stocks. After all, that’s where the big potential gains are, right? So, naturally, some of that money had to come from somewhere, and, well, gold was an easy target. Out with the old, in with the new… or at least, that’s how the thinking goes.

Expert Analysis and Predictions

Analyst Perspectives on Gold’s Future

So, what’s next for gold? Well, you ask ten analysts, you’ll probably get fifteen different answers. Some folks are saying this is just a temporary blip, and gold will bounce back because, let’s face it, the world’s still got plenty of things to worry about. Others are a bit more pessimistic, figuring the price might keep sliding for a while.

Potential for Rebound

Don’t count gold out just yet, though! There are still things that could give it a second wind. What if inflation starts creeping up? What if those trade tensions flare up again? And let’s not forget all those other geopolitical hotspots around the world. Any of those could send investors running back to the safe embrace of gold.

The 2% dip in gold prices really shows you how quickly the market can react to, you know, global news and stuff. This US-China trade thing? It messed with investor’s heads, and they bailed on safe-haven assets. The short-term future? It’s anyone’s guess. But there are long-term factors that might bring the shine back to gold. So what do you think? Will gold recover? Will this trade agreement hold? It’s always a guessing game, isn’t it?

seeme

seeme