Gold and silver are back in the spotlight, and it’s not just because they look pretty. Investors are flocking to these precious metals as safe havens. Think of it as everyone collectively deciding they need a financial security blanket. Let’s dive into what’s making gold and silver so attractive right now, what’s been happening with their prices, and how you might want to get in on the action. I mean, who doesn’t love the idea of a bit more financial security?

Key Drivers of the Gold and Silver Rally

Geopolitical Instability and Economic Uncertainty

When the world feels like it’s teetering on the edge of… well, something not great, people tend to run towards things they see as stable. Gold and silver have been those “things” for centuries. Wars, political upsets, economic downturns – you name it, these metals often see a surge in demand. It’s like everyone’s thinking, “Okay, maybe my stocks are doing the tango, but at least I’ve got some gold!” Feels kinda good, right?

Inflationary Pressures and Interest Rate Hikes

Inflation’s been a real buzzkill, hasn’t it? And what about those interest rate hikes? Ugh. Usually, when inflation goes up, so do gold and silver prices. It’s a hedge, you see. Central banks raising interest rates to combat inflation? That can get a bit tricky. Sometimes it helps gold, sometimes it doesn’t. It all depends on how the market interprets those moves. I guess nobody ever said finance was simple!

Weakening Dollar and Currency Devaluation

Here’s a fun fact: the US dollar and precious metals often have an inverse relationship. So, if the dollar weakens, gold and silver tend to shine brighter. It’s kind of like a see-saw. A weaker dollar makes gold and silver cheaper for international buyers, boosting demand. Makes sense when you think about it, doesn’t it?

Increased Demand from Emerging Markets

Don’t forget about China and India! These countries have a huge appetite for gold and silver, both for investment and cultural reasons (like, weddings – gold is a big deal!). As their economies grow, so does their demand for these metals, which can really push prices up. Maybe we should all learn to say “gold” in Mandarin?

Analyzing Recent Price Movements

Gold’s Performance: A Detailed Overview

Let’s talk numbers. Gold’s had a pretty interesting year. We saw some dips, some peaks, and everything in between. Here’s a general idea of how it’s been:

Hypothetical Gold Price Chart for illustrative purposes only.

It’s been quite the rollercoaster, hasn’t it? Key milestones include breaking through certain resistance levels and reacting to major economic announcements. Keeps things interesting, for sure.

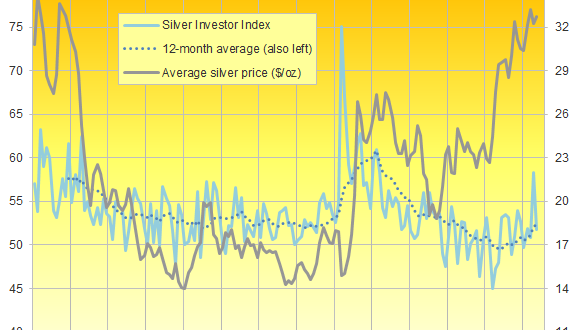

Silver’s Volatility and Upside Potential

Silver is like gold’s slightly wilder cousin. It’s more volatile, meaning its prices can swing up and down more dramatically. But that also means it has the potential for higher gains. Silver isn’t just a safe haven; it’s used in a ton of industrial applications, from electronics to solar panels. So, as the world moves towards greener technologies, silver could really take off. Or not. Who knows? It’s silver!

Comparing Gold and Silver Returns

So, how do gold and silver stack up against each other? Well, it depends on the timeframe you’re looking at. Sometimes gold outperforms silver, and sometimes it’s the other way around. Typically, silver offers higher potential returns, but with higher risk. Gold is often seen as the more stable option. It’s all about your risk tolerance, really.

Investment Strategies for Gold and Silver

Physical Gold and Silver: Pros and Cons

Ah, owning the real deal! There’s something satisfying about holding a gold bar or a silver coin in your hand. On the plus side, you actually own something tangible. No counterparty risk, as they say. The downside? Storage can be a pain, and you have to worry about security. Plus, selling it can be a bit of a hassle compared to other options.

Gold and Silver ETFs: Accessibility and Liquidity

ETFs (Exchange Traded Funds) are like the easy button for investing in gold and silver. You can buy and sell them just like stocks, and they give you exposure to the metals without having to store them yourself. They’re super liquid, meaning you can get in and out of positions quickly. It’s a pretty convenient way to go, if you ask me.

Mining Stocks: Leverage and Risk

Investing in gold and silver mining companies is another way to play the precious metals game. If the companies are successful, you stand to gain big. But mining stocks can be risky. The success of a mining company depends on a lot of factors, including the price of the metals, the company’s management, and, well, whether they actually find any gold or silver!

Gold and Silver IRAs: Retirement Planning

Did you know you can put gold and silver in your retirement account? Yep, it’s a thing. It’s a way to diversify your retirement portfolio and potentially protect it from inflation. There are specific rules and regulations, so you’ll want to do your homework or talk to a financial advisor before jumping in. It could be a smart move for your golden years, though. Get it? Golden?

Future Outlook and Potential Risks

Expert Predictions for Gold and Silver Prices

What do the experts say? Well, that’s the million-dollar question, isn’t it? Some analysts are predicting higher prices for gold and silver, citing continued economic uncertainty and inflationary pressures. Others are more cautious, warning of potential pullbacks. It’s always a mixed bag. Ultimately, nobody has a crystal ball, so take everything with a grain of salt. A grain of gold salt, perhaps?

Potential Downside Risks to Consider

Let’s not get too carried away. There are definitely risks to consider. An unexpected economic recovery could dampen demand for safe havens like gold and silver. Changes in monetary policy, like the Federal Reserve raising interest rates more aggressively than expected, could also put downward pressure on prices. It’s always good to be aware of the potential pitfalls.

Long-Term Investment Strategies

If you’re thinking about investing in gold and silver for the long haul, diversification is key. Don’t put all your eggs in one basket, as they say. Consider allocating a portion of your portfolio to precious metals, but also invest in other asset classes like stocks and bonds. And remember, risk management is crucial. Don’t invest more than you can afford to lose. After all, it’s your hard-earned money, right?

So, there you have it. Gold and silver are definitely having a moment, driven by a mix of factors like global instability, inflation, and increasing demand. Whether you’re a seasoned investor or just starting out, it’s worth considering how these precious metals might fit into your portfolio. Who knows, maybe you’ll find your own little pot of gold (or silver!). Don’t forget to do your research before making any decisions. Happy investing, and may your portfolio shine!

seeme

seeme